If someone is betting heavily against a UK stock I either own, or plan to own, then I’d want to know about it. Luckily, all firms with a net short position greater than or equal to 0.1% of the issued share capital against a listed UK listed company have to report that position to the the Financial Conduct Authority (FCA). The FCA publishes a daily short position update based on the notifications that it receives reporting those company’s with an aggregate net short positions in excess of 0.5% against their issued share capital along with the identity of the position holders.

The top 25 most shorted UK stocks

The short position report from Friday, 16 August, 2024 and its comparison with the one from a week prior is the subject of today’s post. Yet again, Petrofac tops the list with an unchanged net short position against the company’s stock of 9.25%.

Here are the top 25 most shorted UK stocks:

Short sellers have increased their position size against the second placed Diversified Energy Company from 7.65% last week to 7.74% this week. In third place we have Ocado, but the net short position against this stock has fallen from 6.68% to 6.18% over the course of a week.

There has been a change in fourth place with abdrn back with a net short position of 5.61% after an increase of 0.57%. Kingfisher has moved down to fifth place with a net short position of 5.45% compared to 5.33% last week.

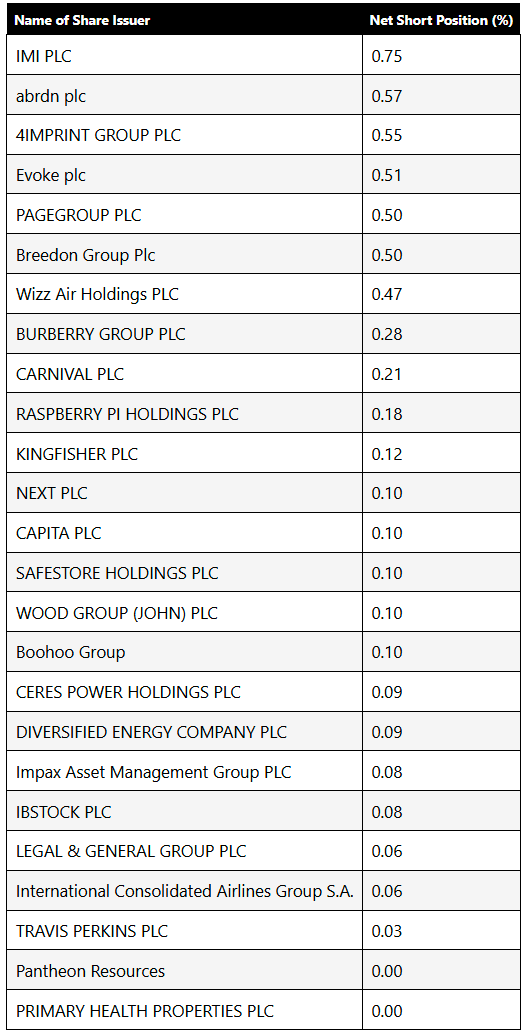

The 25 stocks with the biggest increase in net short position

As well as knowing the stocks with the biggest net short position against them, its well worth looking at those that have seen the biggest increase in the net short position, as this means short sellers are interested in building a position against the stock.

Here are the 25 UK stocks that showed the biggest increase in the net short position against them over the last week:

Abdrn pops up on this list with a gain of 0.57%, which is not surprising since it made a positional leap on the top 25 most shorted UK stocks table. Top spot goes to IMI with a gain of 0.75% in the net short position against it. This company manufactures valves and other systems that are used to control the flow of fluids. It released interim results at the end of July which revealed organic revenue growth of 5%, earnings per share were up by 1%, dividends were increased by 10% and a £100m buyback was announced. The company has already started to make good on the buybacks by retiring 856,044 shares at a cost of £15m. That’s a 0.3% reduction in the share count. I can only surmise that short sellers might view this buyback programme as coming an an inopportune time with the shar price at all time highs, and the cash might be better served paying down debt further. Total debt (loans, leases and overdrafts) stood at £884.2m at the interim statement date which is 96% of total equity £919.8m, add in the pension deficit and its 100%.

The 25 stocks with the biggest decrease in net short position

As well as knowing the stocks with the biggest increase, knowing those stocks for which the net short position against them has fallen the most over the last week is instructive. Short sellers are backing away from these stocks, perhaps they have made their profits and moving on, perhaps they see positive developments down the road for the stock.

Here are the 25 UK stocks that showed the biggest decrease in the net short position against them over the last week:

DISCLAIMER: James J. McCombie owns shares in Kingfisher and Watches of Switzerland. The Storied Investor has no beneficial ownership position in any of the stocks or securities mentioned. No comment in this article should be construed as a recommendation of, or opinion regarding the future performance of, any stock or security or collection of them mentioned herein. Opinions expressed are the author’s and do not represent the views of The Storied Investor.