Patisserie Holdings plc—which had the ticker CAKE—disappeared from the London Stock Exchange‘s AIM market in October 2018. A tax bill of £1.4m arrived and despite having £24m in cash, it could not be paid. That was because the company was far from flush in cash, in fact it was on the verge of bankruptcy, which prompted its board to announce that it had been made aware of potentially fraudulent accounting activities, leading to share trading to be suspended.

Subsequent investigations revealed the cash position was overstated by £30m. there were two overdrafts worth £10m of which the board was unaware. Cheques worth millions and thousands of false ledger entries had been used to used to inflate CAKE’s financial position, leaving a hole in the accounts of about £94m. Despite holding a gun to shareholders heads and asking them to pay up or watch the firm go bust, an emergency equity fundraise, led by chairman Luke Johnson, ultimately failed and the company went into administration in January 2019 leading to the closure of 70 stores and 900 jobs lost. A management buyout backed by Irish private equity firm Causeway Capital Partners means that the rump of the chain still continues on, but it never returned to the public markets.

The UK’s sixth largest accountancy firm Grant Thornton was fined £2.34m in 2021 for failures it made in its audits of Patisserie after admitting it did not follow accounting rules and breached requirements across three separate accounting years. The individual that signed off on the accounts was personally fined £87.75k. The regulator that handed out the fines said the firm had missed red flags and failed to question the information provided by management. It wasn’t the first time Grant Thornton had landed in hot water as it got fined £650k in 2019 over another botched audit. And it was not the last as in 2022 it got another £1.3m fine for serious failings in its audit of Sports Direct accounts for 2016 and 2018.

Have your cake and eat it

Patisserie holdings plc (formerly LSE: CAKE) was, unsurprisingly, a holding company for the following businesses:

- Patisserie Valerie, established in 1926, selling freshly baked premium cakes and pastries, high quality teas, coffees, continental breakfast and light meals

- Druckers – Vienna Patisserie, a Viennese cake shop and continental coffee lounge established in 1964

- Philpotts, a premium sandwich retailer established in 1985

- Baker & Spice, a high end deli and bakery

- Flour Power City Bakery, an organic artisan bakery and wholesaler

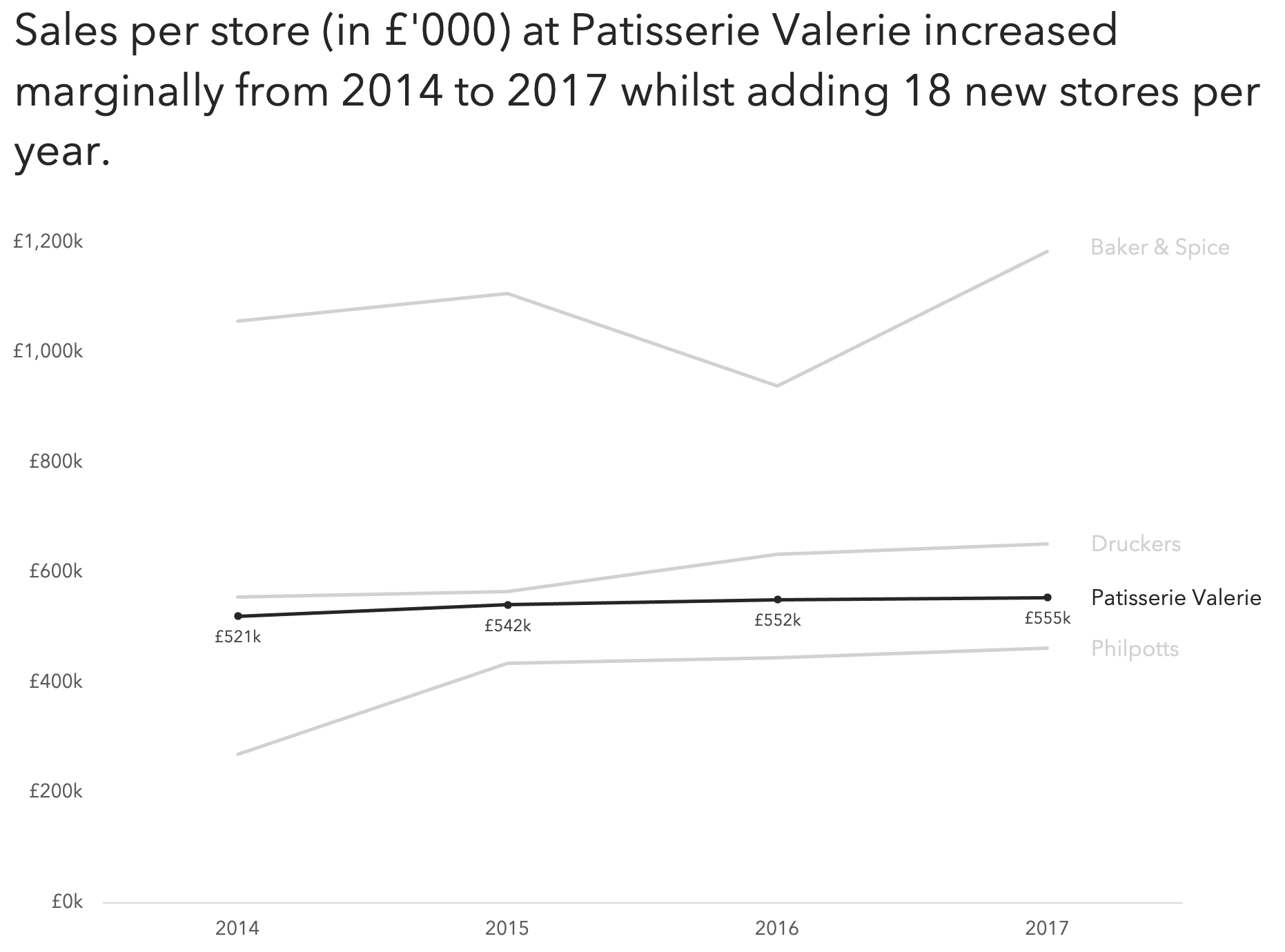

Of the five it was Patisserie Valerie that was the most important as 74% of the company’s revenue came from selling cakes and pastries from its distinctively branded shops. Management opened 18 new stores each year between 2015 and 2017 whist keeping the store or site count of the other businesses flat.

Sales per Patisserie Valerie store increased from £521k in 2014 when there were 98 stores to £555k in 2017 when there were 152 stores. For every 18 new stores added, sales per store increased by £21k, £10k, and £3k over the years. That suggest this is not a growth business. Sure, the company can expand, but as it adds stores, the marginal boost to sales declines.

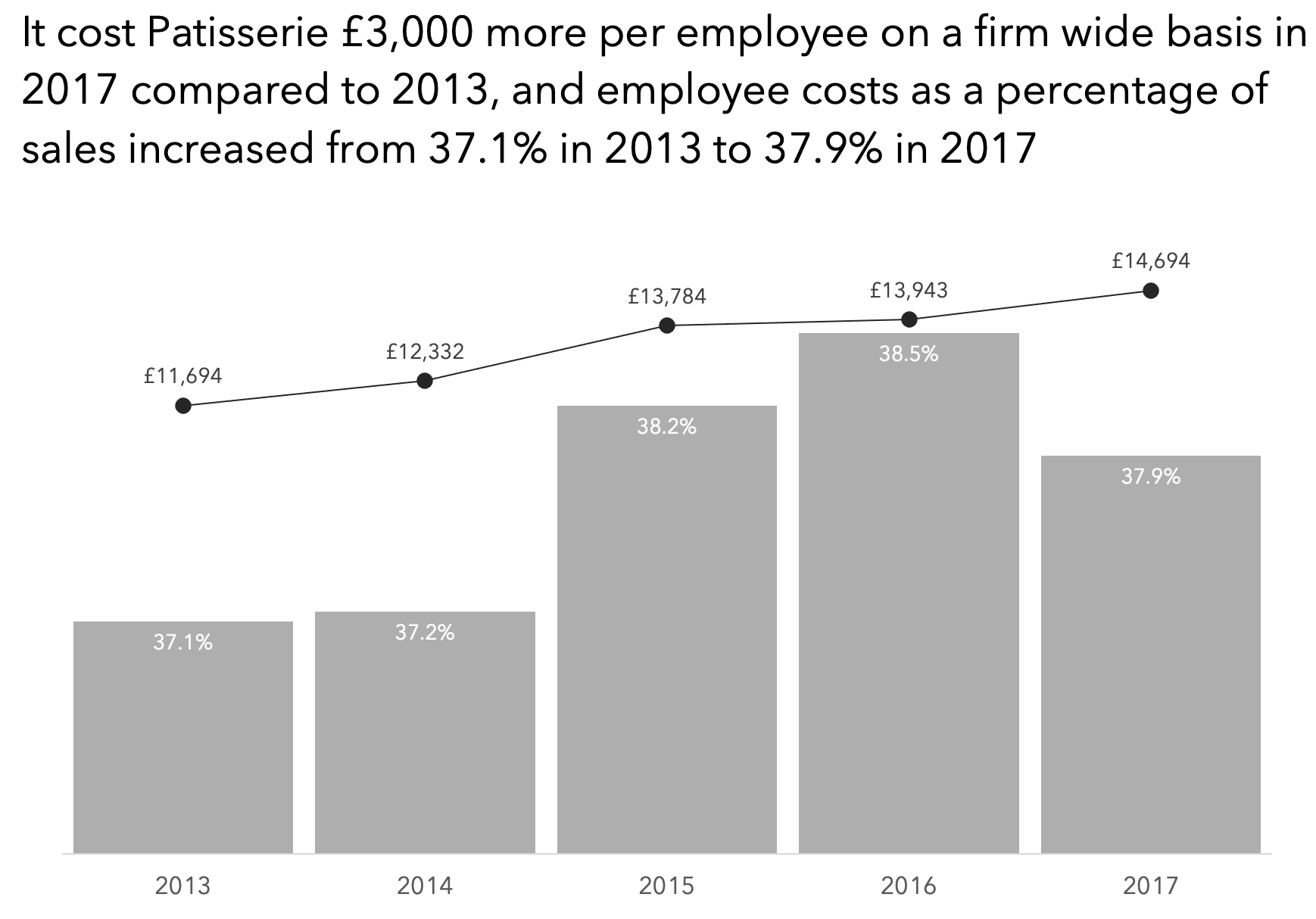

As it added stores the cost of staffing them across the firm increased. The average cost per employee was £11,694 in 2017. By 2017 it had risen by £3,000 to £14,694, which is a 25.7% increase. Compare that to the 6.5% increase in sales per store over the same period and a worrying trend emerges. As a percentage of sales employee costs rose marginally crept higher from 2013 to 2017 from 37.1% to 37.9%.

Employee costs and rents are the biggest expenses for an outfit like Patisserie Valerie. Employee costs were becoming more onerous over the years. If we divide the sales for one year by the lease commitments due in one year from the prior years balance sheet, we can get an idea of the rent expense burden for years 2014, 2015, and 2016 for which the data is available to make the calculation. This actually fell from 13.7% in 2014 to 13.1% in 2016. Thats a positive. Now that could be explained by them opening smaller stores over the years. That would certainly fit with the capital expenditure (CAPEX) as a percentage of sales falling from 11% in 2013 to 8% in 2017. Ultimately, calculating sales per square foot would have better answered this question. However, since the company disappeared from the public markets, we only have access to historical reports from Companies House, and they do not include this information.

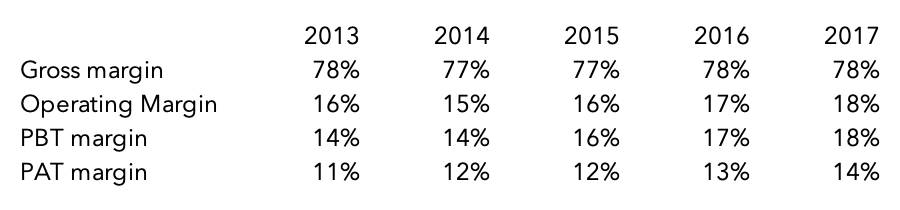

In terms of margins Patisserie looks pretty good. Gross margins of about 78% look good. Operating margins crept higher from 16% in 2013 to 18% in 2017, and profit after tax margins rose from 11% to 14% over the same time. But, although it sells coffee and teas, this business makes it money from selling hand crafted cakes. It was, however, posting comparable margins to Starbucks which had operating margins of around 19% on average and net profit margins of 13% on average between 2013 and 2017.

Starbucks sells a good bulk of its coffee as takeaway. Patisserie has a need to seat customers to eat their pastries. The raw ingredients for coffee and tea are cheap and you can make a margin of up to 95% per cup. This is much higher than the 60% you can usually get from food sales. Indeed, according to St Martin’s Coffee Roasters, coffee shop owners need to shoot for a gross margin of 75%. Patisserie was hitting coffee shop gross margins, and competing with the worlds biggest coffee brand in terms of operating and net profit margins, and doing it with rising employee costs, declining marginal sales per store, and spending less in proportion to revenue each year as it opened the same number of new stores each year.

What did the insiders know that we didn’t?

In hindsight, the analysis above might look suspicious. But would it have been enough to dissuade me to invest in the company if I was looking at it back then in fear of dodgy accounting? I don’t think so. But it might have been enough to convince me that this was not the stock market darling that the share price chart suggested. There were, however, other signs of trouble ahead.

When board and management members of a comply start selling their shares, it could be perfectly innocent. Maybe they need the cash for a big purchase. Maybe they feel having all their money tied up in one stock is risky and are diversifying their portfolio. But, when insiders start selling after a price rise, it should always raise suspicions that maybe they think the price rise is unjustified. The Patisserie Valerie, share price, or more accurately that of its holding company, listed in 2014 at 277p. after a small dip, it went pretty much straight up, hitting a high of 498p in June 2018.

At the start of 2018 the CEO and finance director and another non-exec director cashed in shares in the company worth £5.9m. In June of the same year, despite Patisserie Valerie reporting it was doing just fine whilst its peers were struggling, various members of the board sold £7.2m worth of shares. If you are British, you might remember that there was a heatwave in June, July and August 2018. Cake was not on the menu for many Brits as they sweated those months out. That was why competitors were struggling, but seemingly Patisseries customers were built different. Those insiders must have been counting their blessings as by October 2018, their share holdings lost all their liquidity.

In October 2018, after the accounting scandal became public the Financial Times ran an article revealing a little more about the share dealing activity of the companies CEO and CFO. They held 1m and 666,666 options with an strike price of 170p respectively under their long-term incentive plan (LTIP) as of September 2017. The plan allowed them to cash in if the company’s earnings growth bettered the retail price index by 18% or more over a three year period. It did, perhaps now unsurprisingly. And in February 2018, they cashed in, almost at the first opportunity, by exercising the options and immediately selling them, in full, without relating a single share. In July 2018, the company again announced the award of 1m and 666,666 options, with the same 170p strike price to the pair, despite them exercising the lot six months prior. Again the pair cashed in. There was only one LTIP award mentioned in 2017. There was no mention of this separate tranche. It couldn’t have come from the employee share option plan as this had a different strike price for its options. The auditor, Grant Thornton, didn’t pick up on this oddity, either, again perhaps unsurprisingly.

Now these suspicious share dealings were spotted in hindsight. But, again, this is another hint as to what night have been coming. These hints are of no use for shareholders in Patisserie Valerie, they lost everything it seems, including the emergency funds they helped raise after the scandal went public. The CFO has been charged with fraud as of 2023 along with his wife, and two others. The CEO resigned and now heads up a private management consultancy company if you can believe that, along with being a director of two companies that are involved in letting, perhaps the letted properties were bought with his windfall.