If someone is betting heavily against a UK stock I either own, or plan to own, then I want to know about it. Luckily for me, all firms with a net short position greater than or equal to 0.1% of the issued share capital of a UK listed company have to report that position to the the Financial Conduct Authority (FCA). The FCA publishes a daily short position update based on the notifications that it receives. This includes company stock with net short positions in excess of 0.5% against their issued share capital along with the identity of the position holders.

The FCA’s daily short position update is an important source of information for those who invest in UK stocks. I tend to ignore most of the daily updates and focus on the Friday one (today is an exception). There a a few things I like to do with it. In this post I will be looking at the short position update from Friday, 05 April, 2024 and comparing it to the one issued one week before.

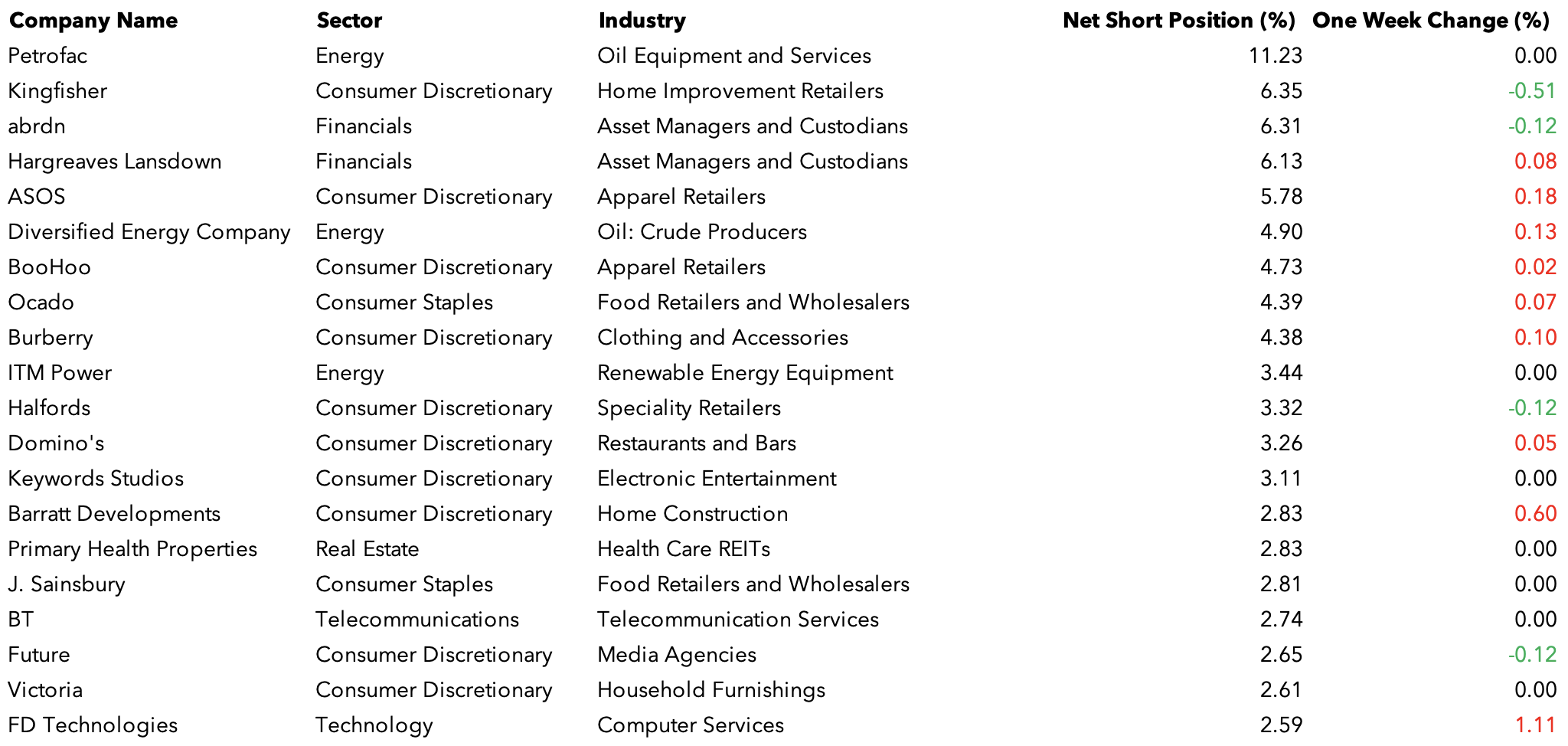

Top 20 most shorted UK stocks on Friday, 5 April, 2024

Petrofac has topped these top 20 most shorted stock lists for Months now. No change in the net short position (NSP) the week, but it did grow by 0.14% in the previous week and now sits at 11.23%. Kingfisher retains its second place spot with an NSP of 6.35%, but it is shrinking, this week by 0.51%, after falls in previous weeks. In third place is abrdn on 6.31% after 0.12% fall in its NSP and Hargreaves Lansdown, another financials sector stock, is in fourth (again) into fourth place with a NSP of 6.13% and week-on-week growth of 0.08%.

Speaking of sector and industry trends, alongside the two financial stocks in the top five that are also assets managers and custodians, it’s worth pointing out that half of the twenty are consumer discretionary stocks. Johnson Matthey and B&M have left the top twenty list to be replaced by FD technologies, Barratt Developments

The 10 biggest increases in net short position over the last week

FD Technologies is the stock that short sellers have been building their NSP against the most. They have increased their bets against its share price a hefty 1.11%, propelling it into the top twenty most shorted UK stocks list. Barratt Developments has seen its net short position grow by 0.60% to 2.83%, again propelling it into the top twenty list alongside FD Technologies. Wizz Air has seen its NSP rise by 0.64% to 2.06%, the second biggest increase this week.

Barratt is a house-builder, and last week it was reported that the average price of a UK house fell from £291,338 in February to £288,430 in March ending five consecutive months of increases. That’s a 1% fall, but it was enough to set the markets alight, and crush the price of house-builder stocks and send short sellers after Barratt. February’s house prices were a 16-month high, so perhaps the feeling is that this was a peak.

The 10 UK stocks whose net short position declined the most over the last week

The NSP against Mondi has dropped by 1.24% to 0.50%. Two weeks ago short sellers increased their NSP against the containers and packaging company by 1.33% to 2.11%. Mondi had explored the possibility of taking over its UK rival DS Smith, agreeing in principle on 7 March, 2024 to buy it for £5.14bn. But on 26 March, 2024, a US company, International Paper, threw its hat into the ring with a bigger offer, and Mondi has until 23 April, 2024 to decide to match it or not. Given the upswing in NSP when it seemed Mondi would be buying, and the downswing when the Americans came along, I guess short sellers thought a tie-up would be bad for Mondi.

There is a broader lesson here. Unless the UK government and regulators do something to fix the malaise in UK stocks, they will keep disappearing from UK indexes. They are cheap. That’s evident from the whopping premiums offered to delist them, but no one seems to care aside from strategic buyers.

DISCLAIMER: James J. McCombie owns shares in Burberry, Kingfisher and Watches of Switzerland. The Storied Investor has no beneficial ownership position in any of the stocks or securities mentioned. No comment in this article should be construed as a recommendation of, or opinion regarding the future performance of, any stock or security or collection of them mentioned herein. Opinions expressed are the author’s and do not represent the views of The Storied Investor.