If someone is betting heavily against a UK stock I either own, or plan to own, then I want to know about it. Luckily for me, all firms with a net short position greater than or equal to 0.1% of the issued share capital of a UK listed company have to report that position to the the Financial Conduct Authority (FCA). The FCA publishes a daily short position update based on the notifications that it receives. This includes company stock with net short positions in excess of 0.5% against their issued share capital along with the identity of the position holders.

The FCA’s daily short position update is an important source of information for those who invest in UK stocks. I tend to ignore most of the daily updates and focus on the Friday one (today is an exception). There a a few things I like to do with it. In this post I will be looking at the short position update from Friday, 23 March, 2024 and comparing it to the one issued one week before.

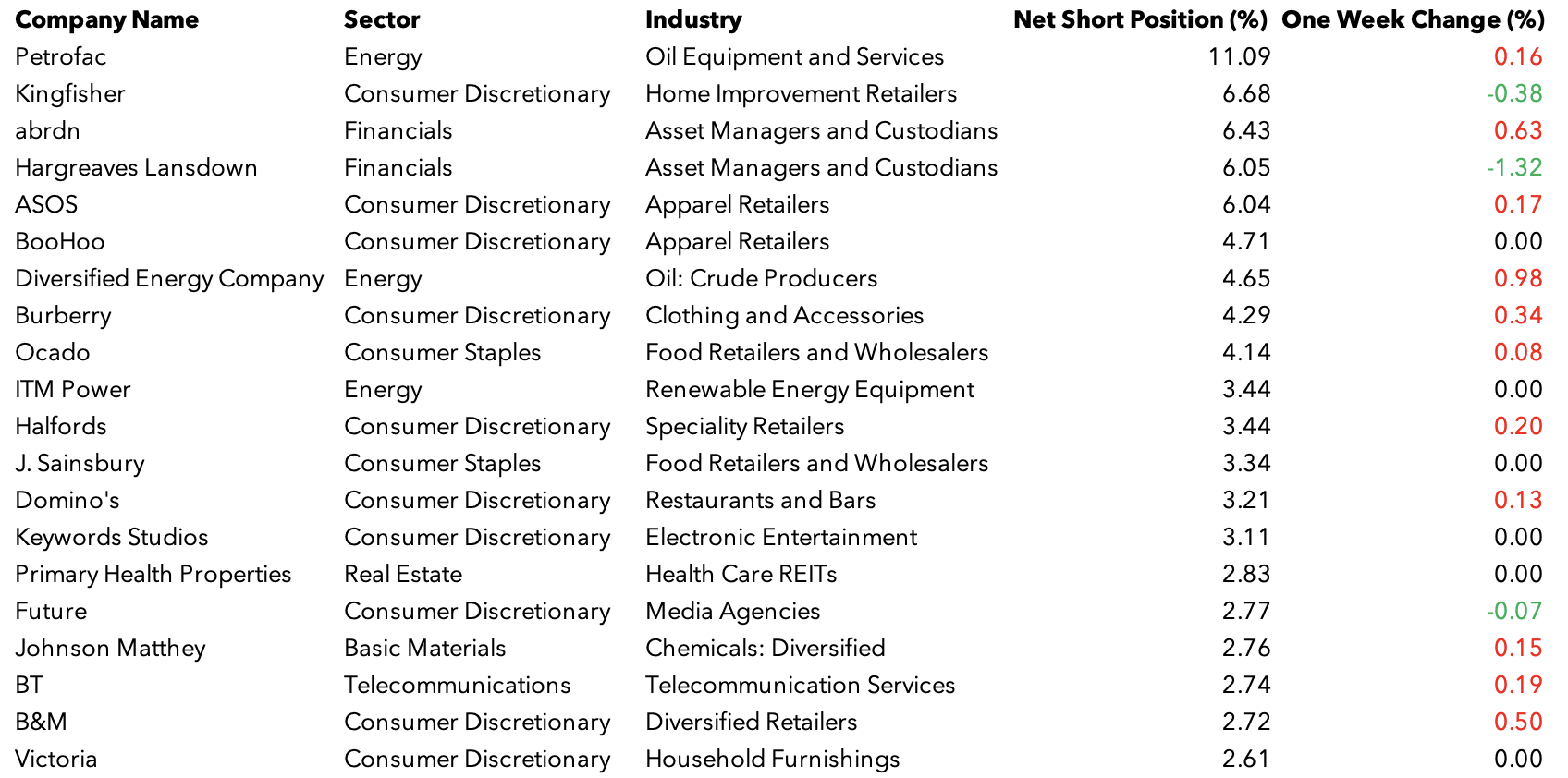

Top 20 most shorted UK stocks on Friday, 23 March, 2024

Petrofac has topped these top 20 most shorted stock lists for Months now. Over the last week the net short position (NSP) against the company’s shares has grown by 0.16% to 11.09%. Kingfisher retains its second place spot with an NSP of 6.68%, but it has shrunk by 0.38% and in third is abrdn on 6.43% after 0.63% growth in its NSP which has knocked Hargreaves Lansdown into fourth place with a NSP of 6.05%.

Sector and industry trends in the top twenty most shorted UK stocks that are worth pointing out include the two financial stocks in the top five that are also assets managers and custodians. Half of the twenty are consumer discretionary stocks.

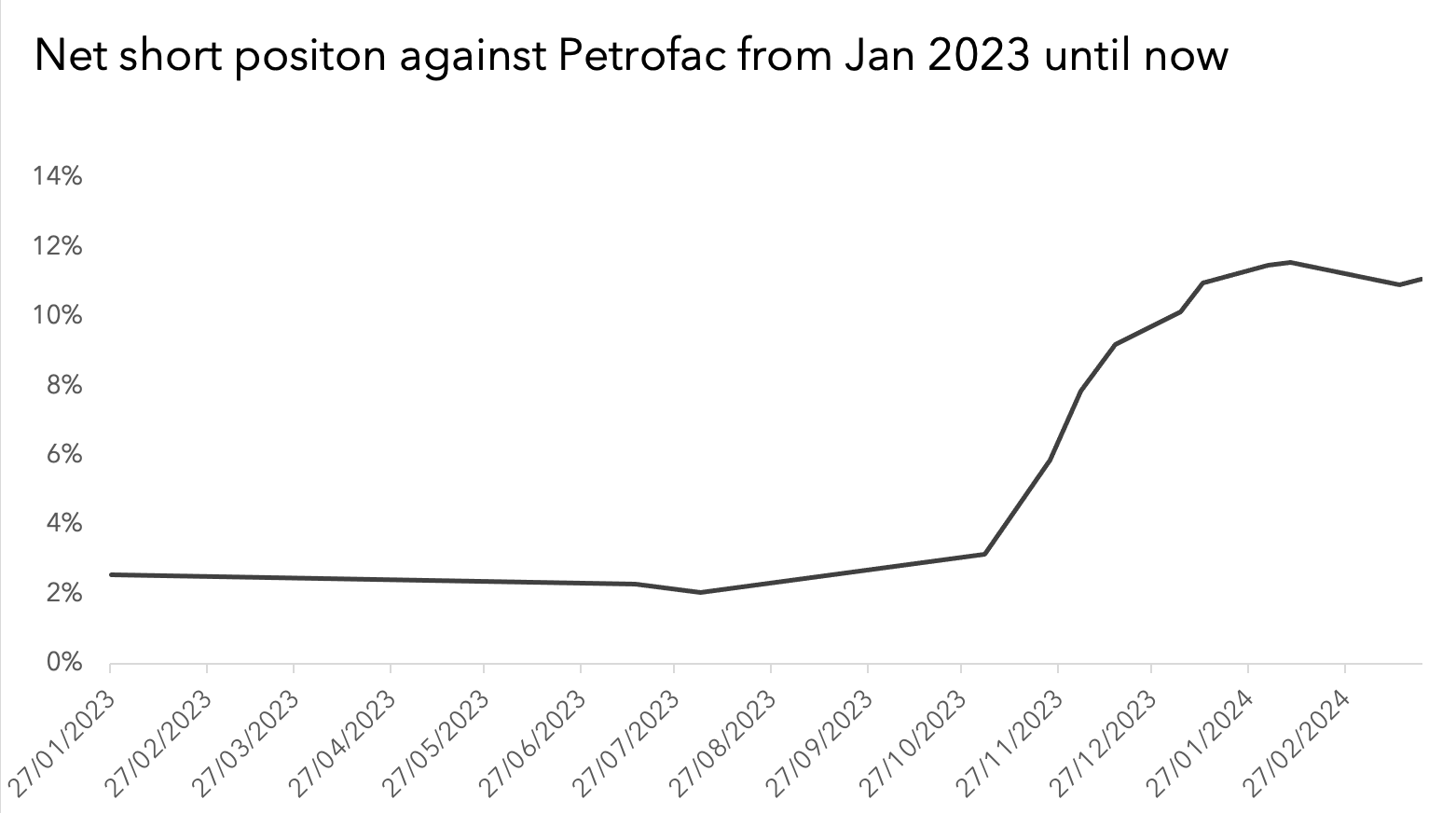

And we have to say something more about Petrofac. This stock appears to have attracted the attention of short-sellers for some time. From mid-to-late 2023 onwards they really started to pile in. The catalyst, which also kicked off a decline in the share price of the stock, looks like the 10 August, 2023 release of half-yearly results. Revenue was down on the same period from a year before, hinting at another full year of revenue decline to add to the previous five.

Although management was then, and remains now, enthusiastic about the future, and report lots of contract wins and work in the pipeline—on 8 March, 2024 it reported another win of a three-year operations contract from Turkemengas at the Galkynysh Gas Field, in Turkmenistan worth over $200m—servicing bad legacy contracts are adding to debt and sucking cash out of the company. Although these are being cleared it looks like the good stuff is still being edged out. Analysts do seem to think the situation will improve. as they have pencilled in revenue and earnings growth of 100% and 19% respectively over the next three years. And of course the stock looks like good value on some metrics as its price is in the pits. Petrofac might be one watch for those that like special situations.

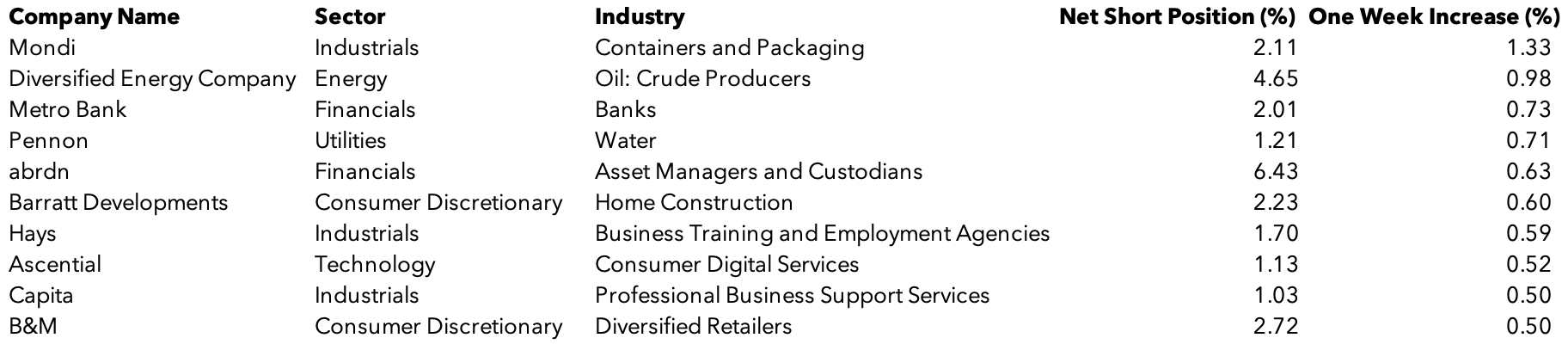

The 10 biggest increases in net short position over the last week

Mondi is the stock that short sellers have been building their NSP against the most: it has increased by 1.33% to 2.11%. Diversified Energy Company stock has a 4.65% NSP now after short sellers added 0.98% to their positions, which was enough to send it into the top twenty list. Metro Bank is once again attracting short-bets against its share price with its NSP rising by 0.73% to 2.01%.

The 10 UK stocks whose net short position declined the most over the last week

Hargreaves Lansdown, the fourth most shorted UK stock, saw the biggest decline in its NSP of 1.32%. Worth noting from those stocks that still have an NSP of greater than 1% after a decline are drax, an energy producer and Watches of Switzerland, a new and previously-owned luxury watch retailer. The NSP against these two companies fell by 0.61% and 0.51% respectively.

DISCLAIMER: James J. McCombie owns shares in Burberry, Kingfisher and Watches of Switzerland. The Storied Investor has no beneficial ownership position in any of the stocks or securities mentioned. No comment in this article should be construed as a recommendation of, or opinion regarding the future performance of, any stock or security or collection of them mentioned herein. Opinions expressed are the author’s and do not represent the views of The Storied Investor.

1 Comment