If someone is betting heavily against a UK stock I either own, or plan to own, then I want to know about it. Luckily for me, all firms with a net short position greater than or equal to 0.1% of the issued share capital of a UK listed company have to report that position to the the Financial Conduct Authority (FCA). The FCA publishes a daily short position update based on the notifications that it receives. This includes company stock with net short positions in excess of 0.5% against their issued share capital along with the identity of the position holders.

The FCA’s daily short position update is an important source of information for those who invest in UK stocks. I tend to ignore most of the daily updates and focus on the Friday one (today is an exception). There a a few things I like to do with it. In this post I will be looking at the short position update from Friday, 10 February, 2023 and comparing it to the one issued one week before.

Top 20 most shorted UK stocks on Friday, 10 February, 2024

Petrofac is still the UK’s most shorted, and it’s been that way since December. Short sellers report are still adding to their bets against the Oil equipment and services company. Over the last week the net short position against the company’s shares has grown by 0.1% to 11.59%. Revenue has declined for the last five years. It has made large and increasing losses in each of the last three financial years, which has wiped out shareholders equity (its now negative). But, management seems enthusiastic about the future, and report lots of contract wins and work in the pipeline. Also, analysts think revenue and earnings will grow by 108% and 19% respectively over the next three years. And of course the stock looks like good value on some metrics as its price is in a pit. Maybe one watch for those that like special situations.

Kingfisher retains its second place spot with an NSP of 6.76% and Hargreaves Lansdown stays in third is on 6.15% after 0.01% growth in its NSP.

With Moonpig (NSP 2.49%) moving into the top twenty and Rightmove moving out, ten of the top twenty stocks are now consumer discretionary ones and the majority of those are truly directly consumer facing business (Although Keywords Studios is classified as such it does not sell to consumers directly) suggesting a lack of confidence in the ability and desire of consumers to spend discretionary income in the future. Two stocks are supermarkets and these are consumer staples stocks. That might suggest short sellers think basket sizes of food and drink will shrink as well, or perhaps shoppers will be trading down from premium products (which I assume command a better margin) to budget alternatives. The impression is that the short sellers don’t have much confidence in the spending power if the UK consumer going forward.

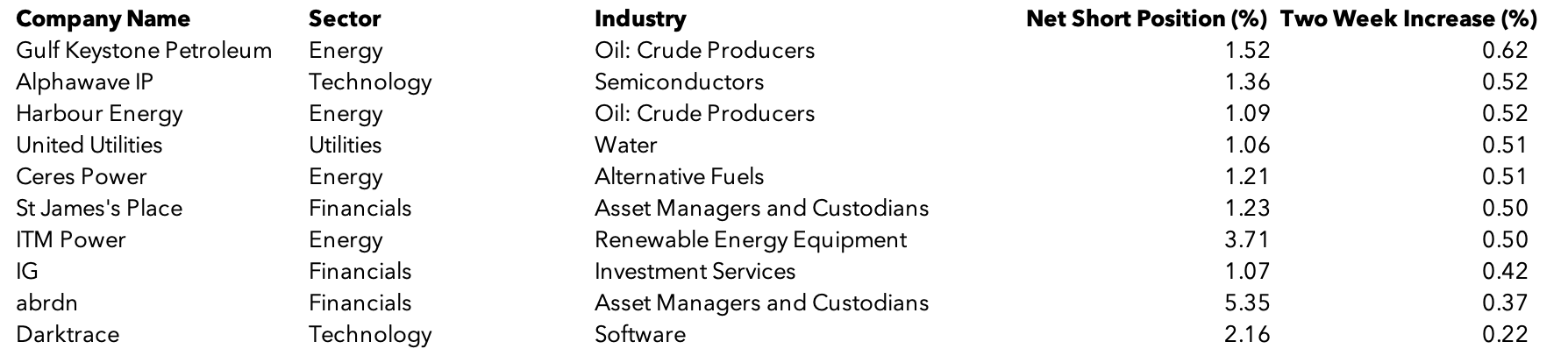

The 10 biggest increases in net short position over the last week

Gulf Keystone Petroleum is the stock that short sellers have been building their NSP against the most: it has increased by 0.62%. Energy and Financial sectors seem to be under attack this week, accounting for seven of the top ten. Technology companies Darktrace and Alphawave IP, plus utilities firm United Utilities compete the top ten.

The 10 UK stocks whose net short position declined the most over the last week

Short sellers are backing off from Burberry. Its NSP has decreased by 1.32%. Rightmove also appears here with a decline of 0.23% which took it out of the top twenty most shorted stocks in the UK list.

DISCLAIMER: James J. McCombie owns shares in Burberry, Kingfisher and Greencore. The Storied Investor has no beneficial ownership position in any of the stocks or securities mentioned. No comment in this article should be construed as a recommendation of, or opinion regarding the future performance of, any stock or security or collection of them mentioned herein. Opinions expressed are the author’s and do not represent the views of The Storied Investor.

1 Comment