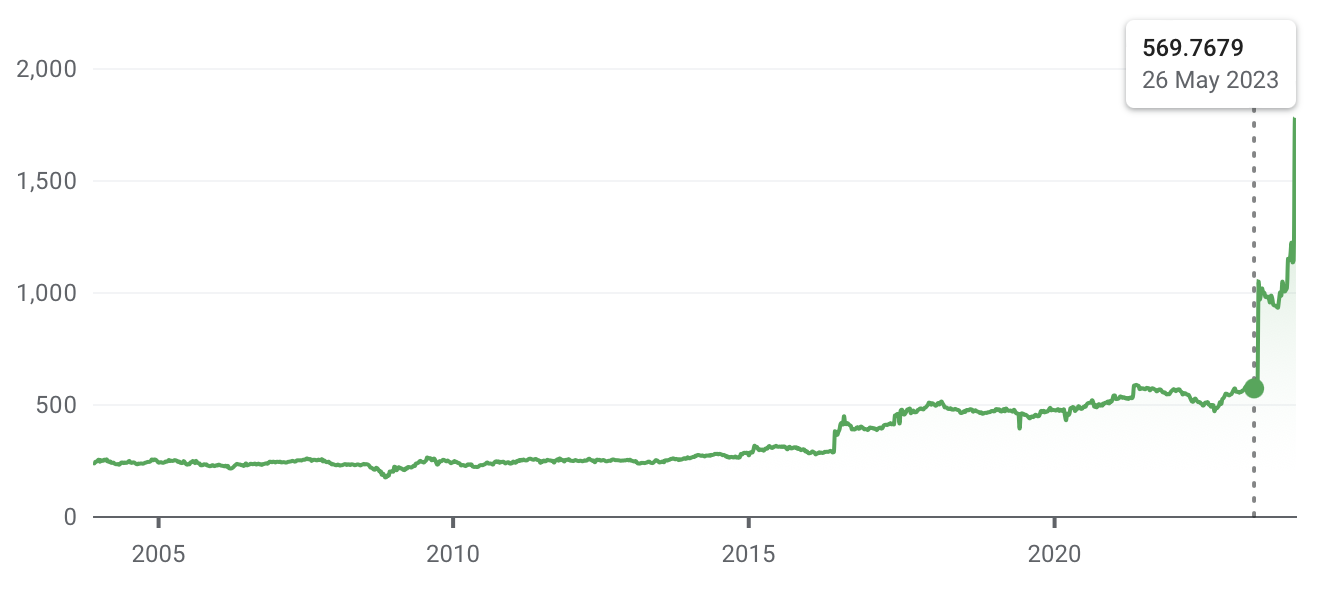

Since about 2015, the number of Nigerian Naira one British Pound will buy has been steadily climbing. That means the Naira is devaluing or weakening relative to the Pound. Around the end of May 2023 the Naira really started to collapse in value. From then until now the number of Naira one Pound will buy has increased from 570 to 1,777, which is a 109% decrease in the value of the currency of Africa’s biggest economy.

PZ Cussons financial year ended on the 31 May 2023. It’s first half of 2024 were thus exposed to a precipitous slide in the value of the Naira. Thats a problem for a company that has a big subsidiary business in Nigeria yet reports and pays dividends in Sterling. So, when the company reported its results for the period from the first of June 2023 to the 2 December, 2024 today it had some bad news to convey to its investors. Their interim dividend would be cut and results from their Nigerian business in particular were disappointing both before and especially after being translated back into Sterling.

PZ Cussons interim report 2024

Group revenue was reported at £277.1 for the first half of the 2024 financial year, down from £336.9m for the first half of the 2023 financial year (FY). A lot of that is due to currency movements, as group like for like sales increased. But still, the operating loss of £89.7m contrast sharply with the operating profit of £39.2 in the prior period. No amount of reporting adjusted numbers wherever possible, including trying to erase the effects of a whopping £88.2m foreign exchange loss, would sway investors, and they sold their PZ Cussons shares knocking their price down by 16.56% at the time of writing.

Founded in 1884, PZ Cussons is home to around 50 well-loved and trusted consumer goods brands like Carex, Imperia Leather, Childs Farm, Morning Fresh, Original Source, Santuary Spa, Rafferty’s, Venus, and St tropez.

It’s markets include the UK, US, Australia, Indonesia and Nigeria, and it has brands grown and tailored for each market as well as global ones.

This likely won’t be a one half thing either. The half year results capture a slide in the Naira Sterling FX rate from 577 to about 1,000. A collapse of half. Since PZ Cussons closed its books for the first half of FY 2024 the Naira has slid further to 1,777. So, unless the currency recovers quickly, Investors are fearing more bad news in the full year numbers. Management warned of this anyway if it wasn’t already clear.

And investors are right to be worried. The Nigerian business is important to PX Cussons. It’s worth 35% of reported revenue, and if you index rates back to before the Naira fell off a cliff its worth much more. A lot of cash is held in Nigeria—Naira cash balances account for 79% of the reported Sterling cash total—as a are lot of assets as the slide in net assets from £422.1 on 31 May, 2023 to £271.5 in the interim report was blamed on the reduction of value in the Naira.

Why the value of the Naira matters to PZ Cussons

FX rates don’t matter so much for a business that operates entirely in Naira. But, the interim report talks about Naira denominated liabilities, but also USD and Sterling ones. With so much cash tied up in Naira, making USD and GBP interest and principal payments gets tricker. Dividend payments in Sterling are harder to complete as the contribution to them from Nigerian business cash falls as the FX rate deteriorates. Thats why they cut the dividend.

A business can protect against currency movements by hedging. In the case of PZ Cussons, knowing that the Naira is volatile they would buy derivative instruments that increase in value as the Naira declines, to offset the effects of that situation on its revenues. However, looking at the balance sheet the carrying value of financial instruments declined, which is probably due to amortisation. But in the statement of comprehensive income there are relatively low amounts of fair value movements being passed though. I don’t think PZ Cussons is hedging its Naira exposure to any appreciable degree.

Given there are such large cash balances in Nigeria you would think that they would be keen to protect their value. Unless of course there are big expansion plans that that cash is earmarked for. Now that might worry investors even more. The Nigerian business has proven to be volatile due largely to those currency movements, and hardly where you want management to be looking to expand.

However, I don’t think thats the case. Some £13m of cash was repatriated in the half year and more is earmarked to follow. That perhaps suggests that there are some issues in getting cash out of the country, either because of restrictions or difficulty exchanging Naira. Then there are the plans to delist and buy-out minority shareholders in Nigeria. Perhaps thats what the Naira balances are for. But from experience, I know that a lot of economic activity in Nigeria is carried out in USD. PZ Cussons admits as much when it states that it is strengthening its ability to source USD for its Nigerian business. It might need the Naira to buy USD rather than borrowing from other group entities. Or, getting out of the Nigerian property market might have made it cash rich there from asset sales.

Whatever the reason, holding some 78% of cash in a currency of country whose business segment delivers only 35% of revenues seems to be a bad decision, especially when you know that currency is volatile.

DISCLAIMER: James J. McCombie does not own any of the shares mentioned. The Storied Investor has no beneficial ownership position in any of the stocks or securities mentioned. No comment in this article should be construed as a recommendation of, or opinion regarding the future performance of, any stock or security or collection of them mentioned herein. Opinions expressed are the author’s and do not represent the views of The Storied Investor.