Given that I still own shares in Scottish Mortgage (LSE: SMT) I have already decided that any reasons can find to avoid the stock are outweighed by the points in favour of holding stock in this high-tech and growth focused investment trust in my portfolio.

The thing I keep coming back to with this stock is the chart below. Ignoring the pandemic years and the massive price distortions, there does seem to be some sort of underlying trend growth rate in the Scottish Mortgage portfolio. It looks like the price is moving back towards trend and if anything is undershooting it. Now, there are a lot of assumptions here, for one thing I assume this is some sort of replicating portfolio that remains constant over time, according to mix, and managers.

But relying on a reason for holding a stock, no matter how much I might like it, is not wise. So with that in mind I thought I would try and write down all the reasons for and against holding Scottish Mortgage shares in my portfolio. I find this a useful exercise to do when reviewing my portfolio holdings. In this case I am sticking with this stock.

Reasons I would buy shares in Scottish Mortgage Investment Trust

1. Diverse Portfolio of Disruptive Growth Companies:

- Scottish Mortgage’s portfolio comprises disruptive growth companies, including young firms in emerging sectors such as AI-enabled healthcare, decarbonization, and the digital revolution.

- The trust’s largest holdings, both public and private, are reportedly growing their revenues by an average of 40% per year, indicating strong potential for future growth.

2. Focus on Mega-Trends and Innovation:

- The trust targets mega-trends, including AI-enabled healthcare, decarbonisation, and the space economy, providing exposure to innovative sectors with significant growth potential.

- Investments in technology giants like Nvidia, ASML, Amazon, and SpaceX contribute to the trust’s solid portfolio of growth stocks.

3. Long-Term Investment Approach:

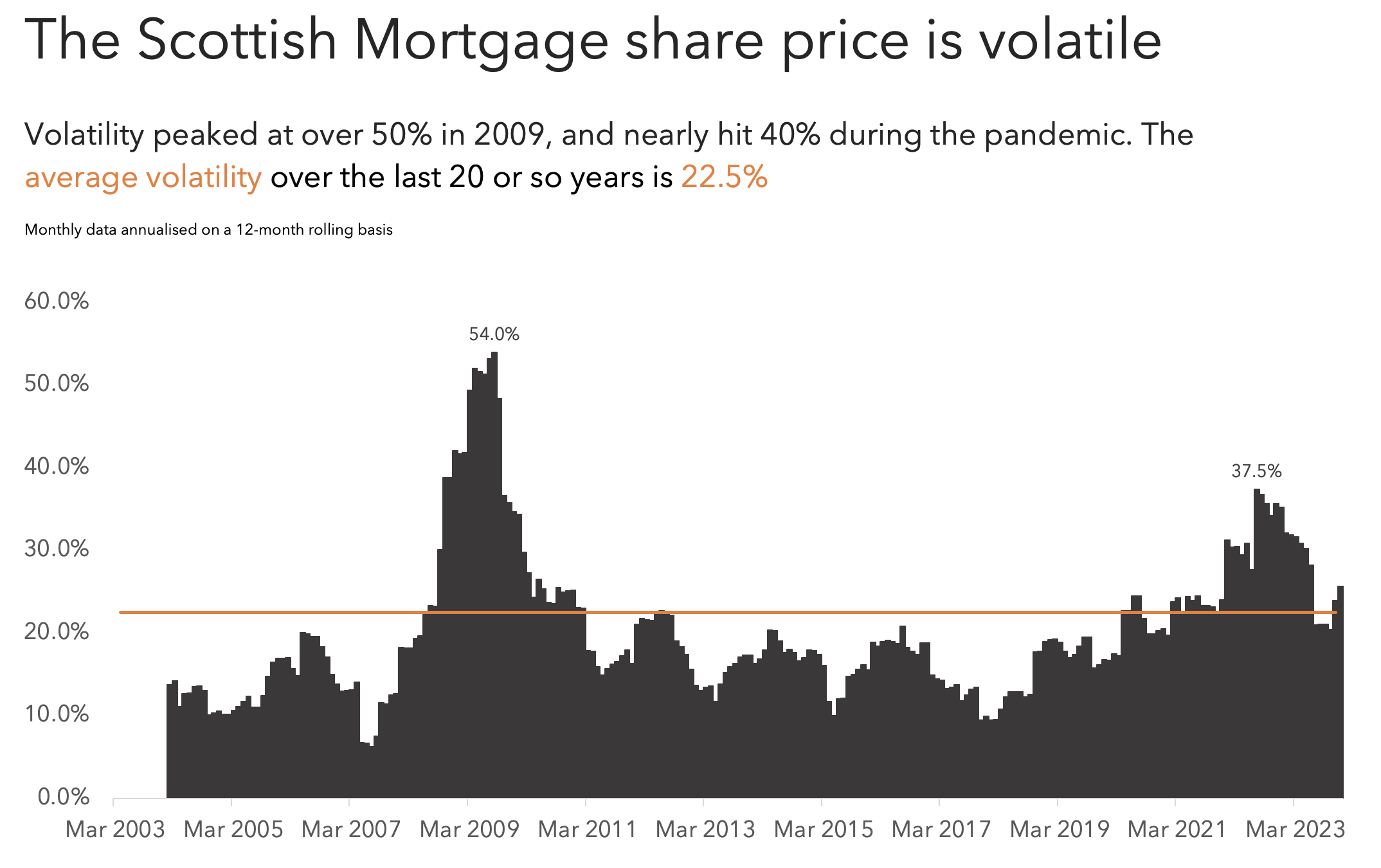

- Despite volatility due to the disruptive nature of its holdings, Scottish Mortgage adopts a long-term investment approach, making it suitable for investors with a similar horizon willing to ride out market turbulence.

- The managers, Tom Slater and Lawrence Burns, aim to find and hold “the world’s most exceptional growth companies” for the long run.

4. Potential for Share Price Growth:

- Anticipation of lower interest rates in 2024, particularly in the US, is expected to benefit the trust’s holdings, especially in the tech sector, potentially boosting share prices.

- Morningstar estimates the net asset value (NAV) per share of Scottish Mortgage shares to be 843p. With the Scottish Mortgage share price currently at 755p there is a discount to NAV of 10% which offers an opportunity for price appreciation if sentiment towards tech stocks improves.

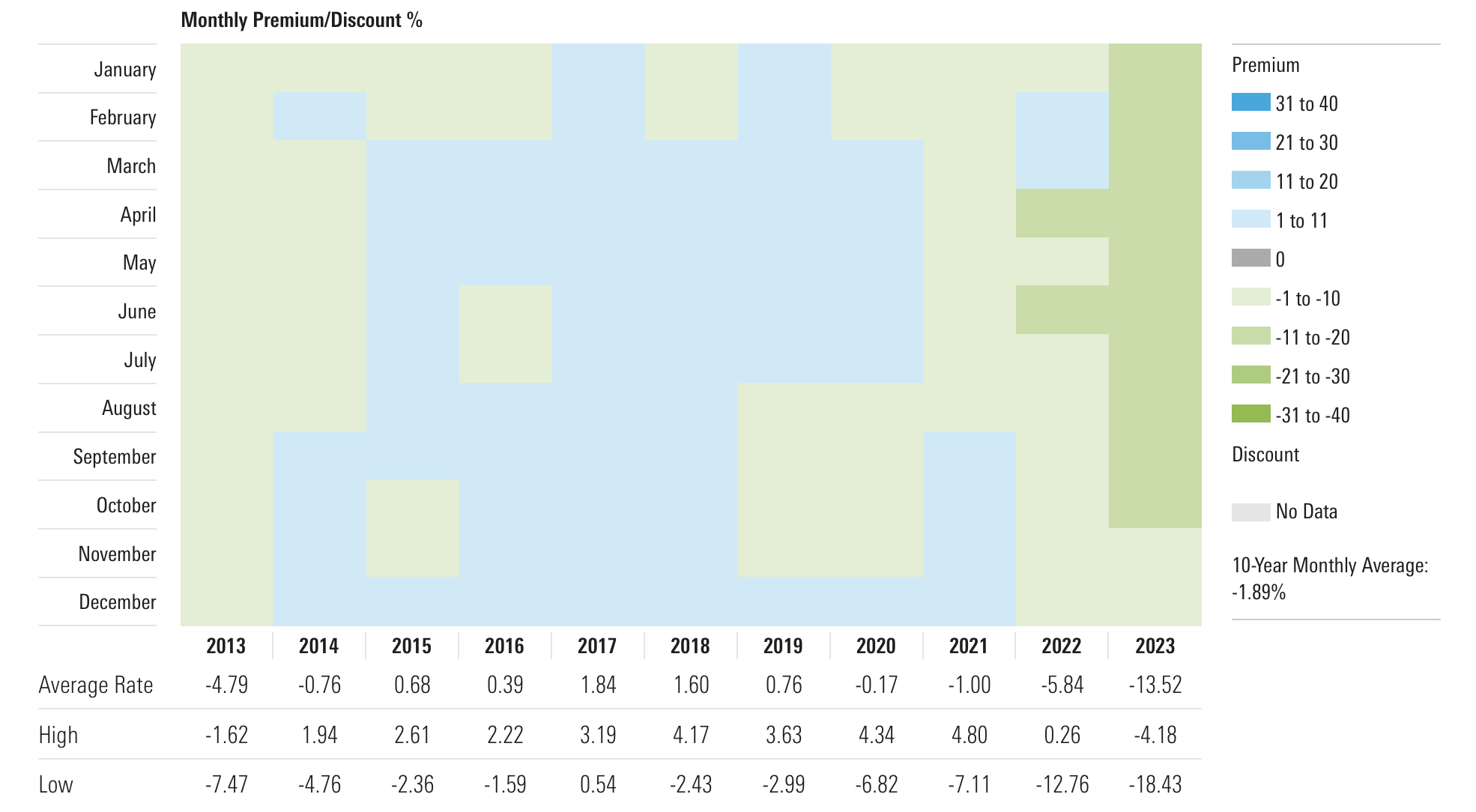

- As the chart below shows the discount during 2023 has been more extreme, but it also highlights that this has not been the case and Scottish Mortgage shares have traded at a premium to NAV in the past.

5. Exposure to Diverse Markets, Including China:

- Scottish Mortgage’s broad and well-chosen selection of companies spans growing markets such as space, electric vehicles (EVs), and biotechnology.

- The trust’s exposure to China, despite potential geopolitical tensions, is seen as a smart move, given the nation’s growing economy and exciting opportunities.

6. Reasonable Active Management:

- The trust has an active portfolio that does not closely resemble major indexes, providing diversification benefits.

- With a low management charge of 0.34%, Scottish Mortgage is considered cheaper than some passive funds, enhancing its appeal to cost-conscious investors.

Reasons I might avoid Scottish Mortgage Stock:

1. Volatility and Interest Rate Sensitivity:

- The trust’s holdings in growth stocks, especially those in the technology sector, make it susceptible to volatility, and higher interest rates could negatively impact these leveraged companies.

2. Historical Performance and Investor Concerns:

- The trust experienced a significant decline in value in 2021/22, causing concern among investors who may be wary of a potential repeat scenario.

- Approximately 25% of the trust’s investments are in unlisted companies, relying on valuations assigned by Scottish Mortgage or the companies’ management, raising transparency and reliability concerns.

3. Sector and Stock-Specific Risks:

- While some top holdings like Nvidia and SpaceX are favored, not all investors may have confidence in the entire top 10, with differing opinions on stocks like Tesla and Moderna.

- The trust’s large weighting to China may present challenges due to ongoing geopolitical tensions, potentially affecting the stock price.

4. Impact of Interest Rate Changes:

- Growth stocks, which constitute a significant portion of Scottish Mortgage’s portfolio, may face challenges if interest rates remain high, impacting the ability of leveraged companies to service debt.

5. Uncertainty in Short-Term Performance:

- Despite optimism about a potential share price revival, uncertainties regarding short-term performance and reaching previous high levels are acknowledged by some analysts.

6. Valuation of Private Companies:

- The valuation of private companies in the trust’s portfolio is challenging due to their unlisted nature, potentially leading to misjudgments or overvaluation.

DISCLAIMER: James J. McCombie owns shares in Scottish Mortgage Investment Trust. The Storied Investor has no beneficial ownership position in any of the stocks or securities mentioned. No comment in this article should be construed as a recommendation of, or opinion regarding the future performance of, any stock or security or collection of them mentioned herein. Opinions expressed are the author’s and do not represent the views of The Storied Investor.