A Podcast and a Substack I read both made mention of a book called “What I Learned About Investing from Darwin” by Pulak Prasad. In particular they both chewed over a section about investment success rates and how to improve them.

In an investors universe of stocks there are good ones and bad ones. Good ones produce a good return, bad ones don’t. There are four possibilities, a stock is bought, and it its either good or bad, and a stock is not bought and it’s either bad or good. Obviously an investor would like to buy the good stocks and not buy the bad ones. But, mistakes will be made.

Stock investing sins

The question posed is whether reducing sins of commission is better or worse than reducing sins of omission in increasing the overall success rate. Say there is a universe of 4,000 stocks, and 25% of them are good, the rest are bad.

Suppose we have an investor who can identify good stocks to buy with an accuracy of 50%. That means for every two stocks they buy one will actually be good like they thought it was, the other will be bad. Not a great hit rate. Also, imagine the investor can screen out stocks with an accuracy of 50% meaning that for every two stock not bought, one will turn out to be good. Again not a great hit rate.

Now what is the overall success rate of this investor, meaning how many of the stocks they buy actually turn out to be good rather than bad? The answer is 25% and the situation is shown in the table below. Of the universe of 4,000, 2,000 stocks are bought and the same amount are not bought. Of those bought, and indeed not-bought, 500 will turn out to be good and 1,500 bad.

| Good Stocks | Bad Stocks | |

| Buy | 500 | 1500 |

| Don’t Buy | 500 | 1500 |

So the investment success rate, the number of good stocks that were actually bought as a percentage of all stocks bought, is (500/2000) x 100= 25%. The book asks what is the best way to improve this success rate, is it to improve the accuracy of picking winners, or the accuracy of avoiding losers?

Warren Buffets number one rule is don’t lose money

Let’s say the investor gets better and better at picking good stocks, but their accuracy at avoiding bad ones remains at 50%. How will their investment success rate change? It’s safe to assume that it will increase. But, will it increase faster than if they kept their accuracy at picking good stocks at 50% and increased their accuracy of avoiding bad stocks?

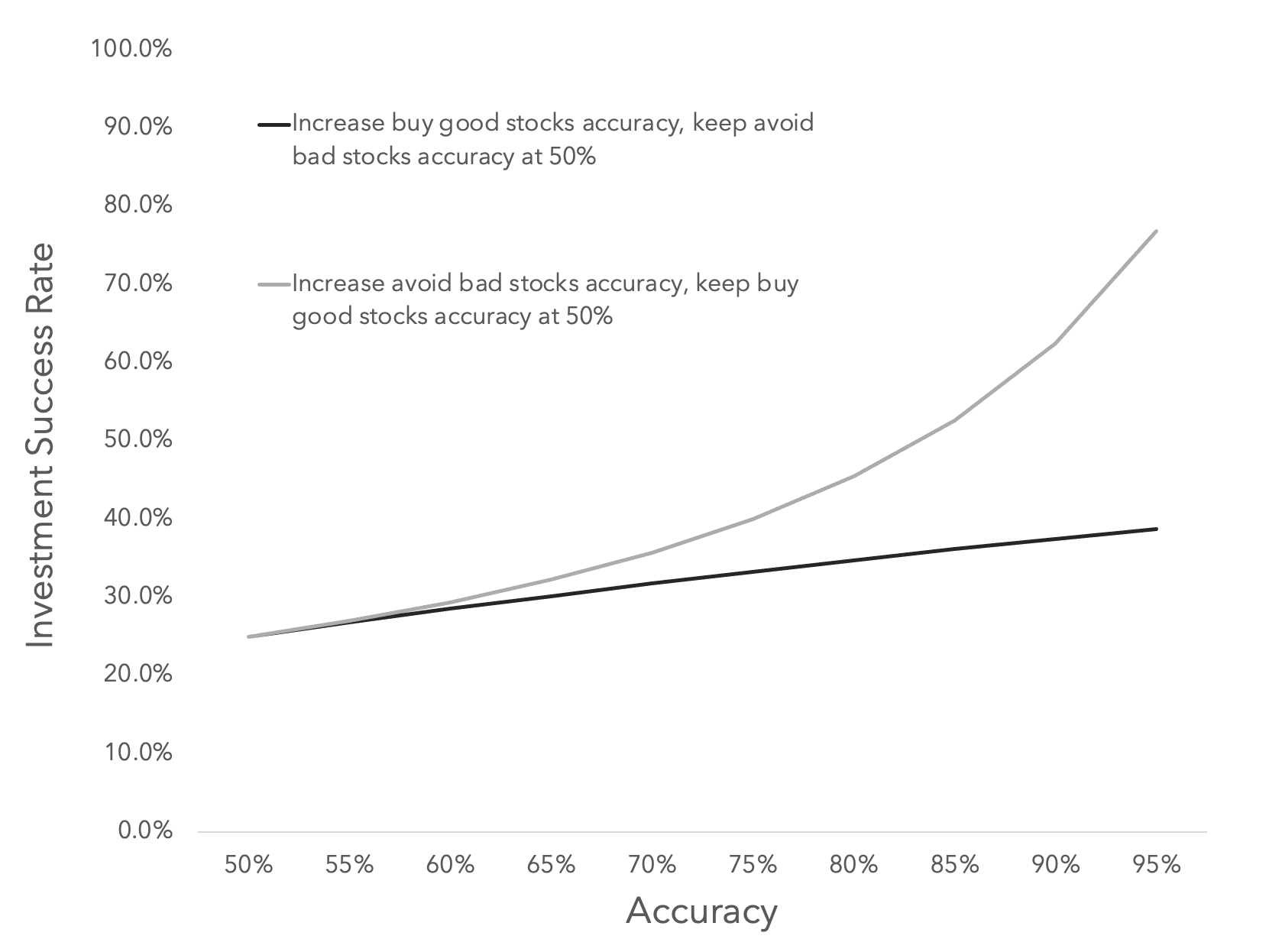

It tuns out its the latter and its not even close. If the investor takes their pick good stocks accuracy from 50% to 95% their investment success rate increases from 25% to 38.8%. Good, but increasing the avoid bad stock accuracy from 50% to 95% takes the investment success rate from 25% to 76.9%.

The graph above gets the starkness of the different across pretty well. Increasing the accuracy at which an investor identifies good stocks for purchase whilst their skill at avoiding bad stocks remains the same gets a roughly linear improvement in investment success. The investor can get exponential improvement by significantly increasing the accuracy at which they avoid bad stocks alone.

Warren Buffets second rule is to not forget the first one

What is going on can be further demonstrated by looking at two more tables, and comparing them to the base case of 50% accuracy for both picking winners and avoiding losers. First up is the situation whereby avoiding bad stocks accuracy remains at 50% but picking good stocks accuracy increases to 80%

| Good Stocks | Bad Stocks | |

| Buy | 800 | 1500 |

| Don’t Buy | 200 | 1500 |

The change here is on the good stocks column, as expected. 300 more good stocks have been bought, and 300 fewer good stocks have been avoided. The investment success rate is 800/(800+1500) x 100 = 34.8%. Thats better than 25%. But, our investor can do better.

How about if their picking good stocks accuracy remains at 50% but the avoiding bad stocks accuracy increases to 80%. The change here is in the bad stocks column. A full 900 fewer bad stocks have been bought, and of course, that means that 900 bad stocks have correctly been avoided. That is a greater absolute change, and the investment success ratio is 500/(500+600) x 100 = 45.4%.

| Good Stocks | Bad Stocks | |

| Buy | 500 | 600 |

| Don’t Buy | 500 | 2400 |

Don’t lose. Its Warren Buffett’s number one rule for investing, and his second one is don’t forget the first (he did say this follow this link to YouTube to see!). Improving the accuracy with which the investor avoids bad stocks obviously means fewer are bought. Fewer bad stocks means less money lost, and that matters more here than picking more winners. Warren Buffett was right, of course.

Fictional stock markets

Picking winners better is not as effective as more successfully avoiding losers in terms of increasing the investment success rate. However, there are some caveats. One is that the two accuracy rates are treated as independent. They won’t be. And of course these are contrived examples. But that doesn’t mean they are not useful in confirming something mathematically that I suspect all investors consider to be true.

One thing to check is what happens when there are more good stocks than bad. So let’s set the proportion of good stocks at 75%. Again let’s set both the accuracy rates at 50%. The investment success rate is 75%. Now let’s increase the accuracy at which good stocks are selected to 95%. The investment success rate increases to 85.1%. If the accuracy at which bad stocks are not selected to 95%. The investment success rate is 96.8%. Warren Buffett is still right.

1 Comment