Marks and Spencer (LSE: MKS) released its Christmas trading report for the 13 weeks to the end of 2023 today at 7am. At the time of writing the Marks and Spencer share price is 264.7p, which is 4.70% below yesterdays closing pice of 277.7p.

A slump in price suggests the report was bad, or at least not as good as hoped. That certainly does fit with the stock opening at 265p, below its prior close. It then moved higher to 270p about 15 minutes after trading opened, but then fell to a low of 261.2p around 10am, and then recovered slightly. A confusing picture then, and the picture does not become immediately clearer on reading the report.

A Remarksable Christmas period

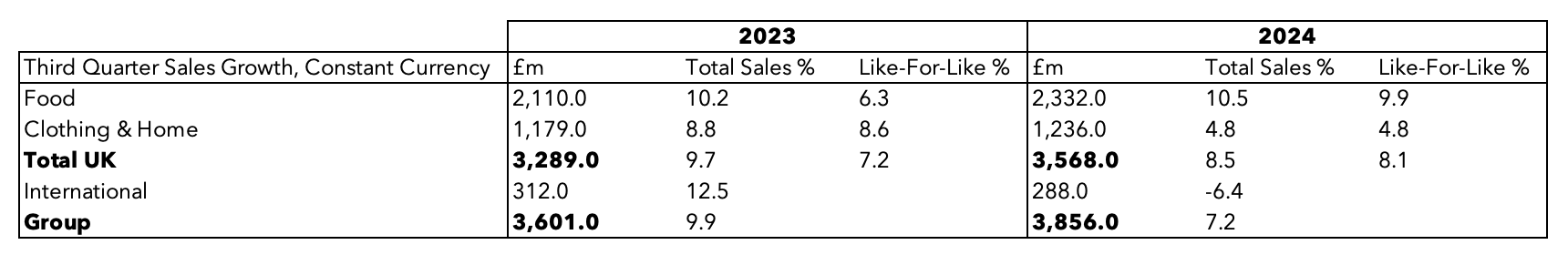

Group sales for the period are up 7.2% year-on-year. UK food sales rose 10.5% and clothing & home sales went up 4.8%. The only blip was international sales, which fell a fairly significant 6.4%. That could well be the reason for the fall in the Marks and Spencer share price today. However, the number is printed very obviously in a table right at the top of the report, which has been reproduced below, with last years numbers added for reference.

The “bad” news being easy to see does not fit with the initial rise of the share price. Moreover, the international segment is tiny compared to the UK ones which are doing well.

The opening paragraphs of the Chief Executives comments are all positive. So, this reaction seems to be linked to something buried deeper in the report, perhaps elsewhere, something that was stumbled on a little later and overreacted too.

Marks and Spencer says it will meet market expectations for 2024

The sections on the food and clothing & home segments seems ok. The company’s “Remarksable” value food line is doing well, growing 18% compared to the same period last year it seems. I must remind myself that I was skeptical of this line, I did think that Marks food had a certain image, and it wasn’t cheapness, I thought this would dilute this, but it seems it hasn’t. Marks to me has always seemed to be were shoppers went to get bits and pieces, not full shops, but the value line, if my buts assumption is true, would change that. Bigger baskets are good.

The international segment, which has shrunk, gets a few lines. Planned timing of franchise shipments in the Middle East and Asia are apparently to blame, along with challenging market conditions in India. Thats all a bit vague. Sounds like their international partners had some supply chain problems. The international segment is worth less than 10% of sales, but it has impressive operating margins compared to the others (it is mainly a franchise operation), so it’s not insignificant. But like I said its misfortune was reported as a headline number.

Maybe it’s the company’s outlook for the near term future? But is there anything surprising about saying that economic growth is uncertain, there are geopolitical risks, and cost inflation is a problem?

As we enter the new year and FY25, expectations for economic growth remain uncertain, with consumer and geopolitical risks. We also face additional cost increases from higher than anticipated wage and business rates related cost inflation. Nevertheless, the strong Christmas trading performance provides confidence that the results for the year will be consistent with market expectations.

MARKS AND SPENCER GROUP PLC CHRISTMAS TRADING – 13 WEEKS TO 30 DECEMBER 2023.

After listing the potential woes the company does state that the expectation is that full year 2024 performance will be consistent with expectations. Perhaps their view of expectations is wrong and in fact the expectation was that the company would beat expectations. And the overall tone is that things are going well but there is more to come.

DISCLAIMER: James J. McCombie owns shares in Marks and Spencer. The Storied Investor has no beneficial ownership position in any of the stocks or securities mentioned. No comment in this article should be construed as a recommendation of, or opinion regarding the future performance of, any stock or security or collection of them mentioned herein. Opinions expressed are the author’s and do not represent the views of The Storied Investor.

1 Comment