The surge in Rolls-Royce (LSE: RR) shares, surpassing a 300% increase since October 2022, has captured the attention of investors and analysts alike. This unprecedented growth has ignited debates over the sustainability of the stock’s valuation and the underlying factors contributing to its dramatic ascent.

Cleared for takeoff

Under the guidance of CEO Tufan Erginbilgic, Rolls-Royce has embarked on a strategic journey aimed at revitalizing the company’s performance. Erginbilgic’s strategic direction emphasizes operational efficiency, profitability, and a series of strategic divestments. The ambitious goal of quadrupling profits within a five-year timeframe has sparked optimism among investors, signalling a renewed trajectory for the company which operates the following business segments.

- Civil Aerospace: The company’s primary businesses. It involves the manufacturing and servicing of engines for commercial passenger flights. This segment has been highlighted as one of the significant areas for potential growth and profitability, especially with advancements in technology and the focus on widebody planes.

- Defense: Another crucial area for Rolls-Royce is the defense sector. The company is involved in providing engines and other solutions for defense purposes, which has been highlighted as a sector that could benefit from increased defense spending worldwide.

- Power Systems: Rolls-Royce also operates in the power systems segment, which includes various power generation solutions. This includes endeavors in sustainable power brands, small modular reactors (SMRs) for nuclear energy, and other electricity generators. This segment has been seen as having potential growth in emerging markets and in advancing sustainable technologies.

Erginbilgic’s strategic repositioning towards supposedly high-yielding segments like wide-body planes and business aviation has resonated positively with stakeholders. The civil aerospace business is said to benefit from a substantial order book and potential for growth. Rolls-Royce’s focus is on improving profit margins in this sector, aiming for significant increases from 2.5% to 15-17% by 2027, suggests a bullish outlook for this division.

The decision to divest non-core assets, including the electrical-powered aircraft business, reflects a deliberate effort to streamline operations and channel resources into areas with hopefully greater growth potential and at least where the company has greater expertise and familiarity. The company’s commitment to technological advancements, notably the UltraFan initiative and sustainable aviation fuel (SAF) focusing on sustainable aviation, showcases its dedication to innovation and future-proofing its offerings which are aligning themselves with global trends towards environmentally friendly practices in the aviation industry.

Moving away from civil aviation, another source of excitement for shareholders is Rolls-Royce’s foray into the realm of Small Modular Reactors (SMRs) presenting a promising avenue of development within its power systems division. Positioned as a beacon of sustainability, these reactors signify a stride towards addressing the global demand for dependable and eco-friendly energy solutions. The company’s steadfast commitment to pioneering advancements in this field underscores a profound dedication to shaping the future of sustainable energy.

Fueling optimism, the SMR business is envisioned as a significant contributor to Rolls-Royce’s trajectory, leveraging cutting-edge technology to carve a path towards cleaner and more accessible energy sources. These reactors, though still in developmental phases, hold the potential to cater to diverse markets, including emerging economies seeking robust and sustainable power options. While progress in technological advancements is apparent, the journey towards the commercialization and widespread adoption of SMRs remains a long-term endeavor, marked by regulatory approvals and market viability assessments.

Additionally, the CEO’s ambitious targets aiming for substantial increases in annual profit margins and free cash flow, complemented by a strategic emphasis on sustainable aviation fuel and advancements in aerospace technology, contribute to the prevailing positive sentiment among shareholders.

Flying into bad weather

Despite the encouraging surge and strategic initiatives, concerns loom regarding Rolls-Royce’s historical financial performance. The negative revenue growth rate over the past decade and erratic swings in net income raise questions about the company’s stability and long-term sustainability. Furthermore, the cyclicality inherent in the aerospace industry, compounded by geopolitical tensions impacting aviation, presents challenges that could hinder Rolls-Royce’s consistent growth.

Moreover, the company’s substantial debt load, particularly the sizable portion maturing between 2025-2027, poses a potential risk factor for its financial stability. Addressing these concerns and executing the ambitious growth plans in a dynamic and volatile industry will be critical for Rolls-Royce’s future success.

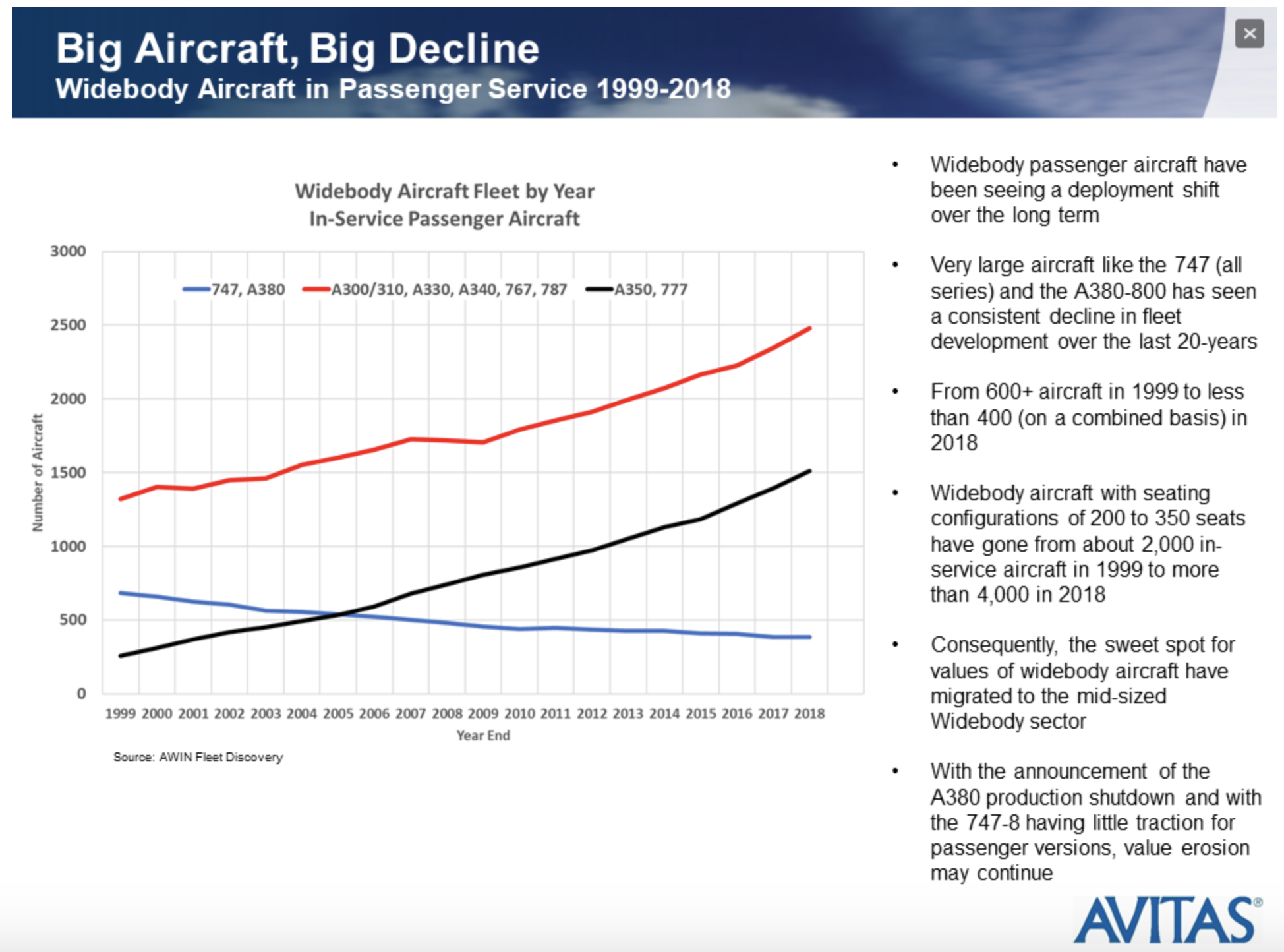

Furthermore, I find the cheer about leaning into widebody planes disturbing. That’s precisely what helped wallop Rolls-Roe during the pandemic and after. Long haul routes, served by wide body planes, were the first to fall and the slowest to recover. Rolls-Royce bills per hour flown for servicing of its engines. It needs planes in the air. And wide-body aircraft have been in decline well before COVID-19 darkened out doors. Check out this graphic from Avitas:

Here’s a hint in reading it: the blue line are wide-body aircraft. Now, I can understand that long haul business routes, served by wide-body planes are more lucrative. As we have said, Rolls-Royce bills for hours flown by its engines. Wide-body aircraft have four, narrow-bodies have two. Long haul routes mean more time in the air relative to time sitting on the tarmac unloading and loading passengers, making multiple turnarounds each day, which is typical of shorter haul routes, flown by narrow-body planes.

And Rolls-Royce’s Small Modular Reactor (SMR) initiative faces several hurdles on its path to commercialization and widespread adoption. Foremost among these challenges are the stringent regulatory requirements and compliance needed for nuclear technologies. Navigating complex regulatory frameworks and ensuring adherence to safety standards could extend timelines for SMR commercialization. Moreover, achieving commercial viability poses a significant challenge, requiring substantial investment, technological advancements, and time to transition SMRs into economically competitive energy solutions. Encouraging market acceptance and adoption presents another obstacle, necessitating the company to convince stakeholders about the safety, reliability, and benefits of SMRs compared to conventional energy sources. Additionally, competing in a dynamic market landscape, addressing public perceptions about nuclear energy, continual technological innovation, securing adequate financing, and scaling up production efficiently are critical hurdles that Rolls-Royce must navigate to propel the SMR business forward.

In summary, Rolls-Royce’s SMR venture faces a multitude of challenges spanning regulatory, commercial, market acceptance, technological innovation, societal perceptions, and financial aspects. Overcoming these hurdles is pivotal for the successful commercialization, wider adoption, and eventual integration of SMRs as a sustainable and competitive energy solution in the future energy landscape.

Balancing power

Rolls-Royce’s recent surge in share price reflects an optimistic response to strategic shifts and ambitious targets set by its new leadership. However, investors are advised to approach with caution, conducting thorough due diligence and closely monitoring the company’s execution of its strategic initiatives. While the stock displays promise, careful evaluation against historical performance and market dynamics is necessary to navigate potential risks and opportunities.

Rolls-Royce’s stock price has experienced an extraordinary surge, increasing by over 300% since October 2022. This has led to the P/E ratio for Rolls-Royce stock hitting levels that are considered exceptionally high, notably above 100 or 130, depending on when you look. The elevated valuation levels could potentially lead to a market correction if the stock price isn’t supported by corresponding improvements in the company’s financial performance. Investors are advised to exercise prudence, considering the potential risk of a correction in the stock price to align with the company’s actual fundamentals.

DISCLAIMER: James J. McCombie does not own shares in any of the companies mentioned in this article. The Storied Investor has no beneficial ownership position in any of the stocks or securities mentioned. No comment in this article should be construed as a recommendation of, or opinion regarding the future performance of, any stock or security or collection of them mentioned herein. Opinions expressed are the author’s and do not represent the views of The Storied Investor.