If someone is betting heavily against a UK stock I either own, or plan to own, then I want to know about it. Luckily for me, all firms with a net short position greater than or equal to 0.1% of the issued share capital of a UK listed company have to report that position to the the Financial Conduct Authority (FCA). The FCA publishes a daily short position update based on the notifications that it receives. This includes company stock with net short positions in excess of 0.5% against their issued share capital along with the identity of the position holders.

The FCA’s daily short position update is an important source of information for those who invest in UK stocks. I tend to ignore most of the daily updates and focus on the Friday one (today is an exception). There a a few things I like to do with it. In this post I will be looking at the short position update from Monday, 4 December, 2023 and comparing it to the one on Friday, 24 November, 2023, so a little over a week.

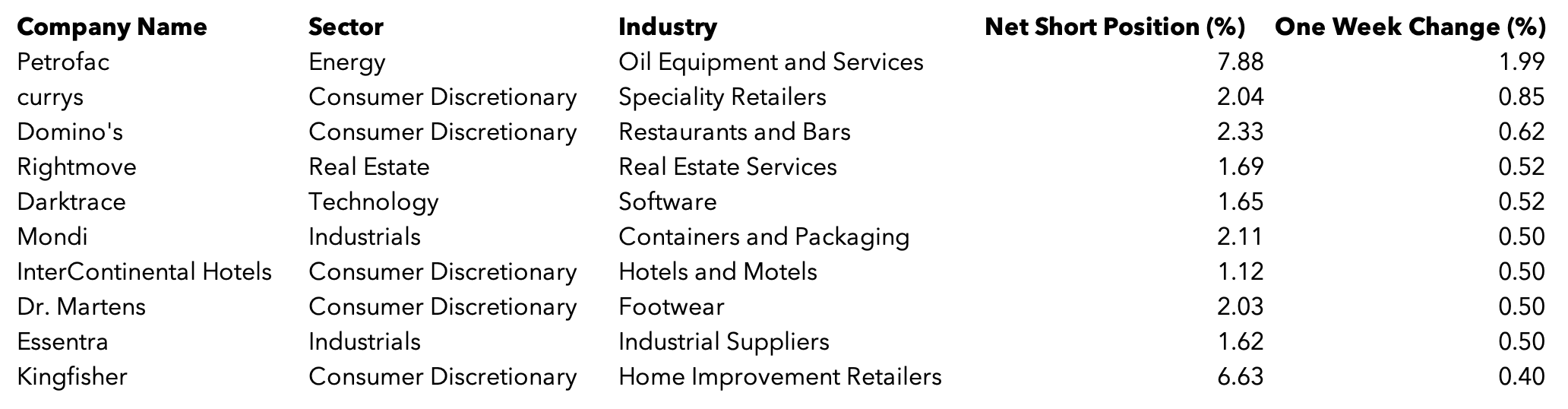

Top 20 most shorted UK stocks on Monday, 4 December, 2023

Petrofac is now the UK’s most shorted stock after short sellers added 1.99% to their net short position against the energy services company which helps design, build and operate and decommission energy facilities like refineries. Here are some highlights from Petrofac’s business update which it released today:

- No longer expects to meet guidance previously issued for full year cash flow

- Board examining a range of strategic and financial options with the objective of materially strengthening the Company’s balance sheet, securing bank guarantees and improving short-term liquidity

I guess the mystery as to why Petrofac has a net short position of 7.88% against it might have been solved.

The 10 biggest increases in net short position over the last week (or so)

No surprises here. Petrofac saw the largest increase in the net short position against it this week.

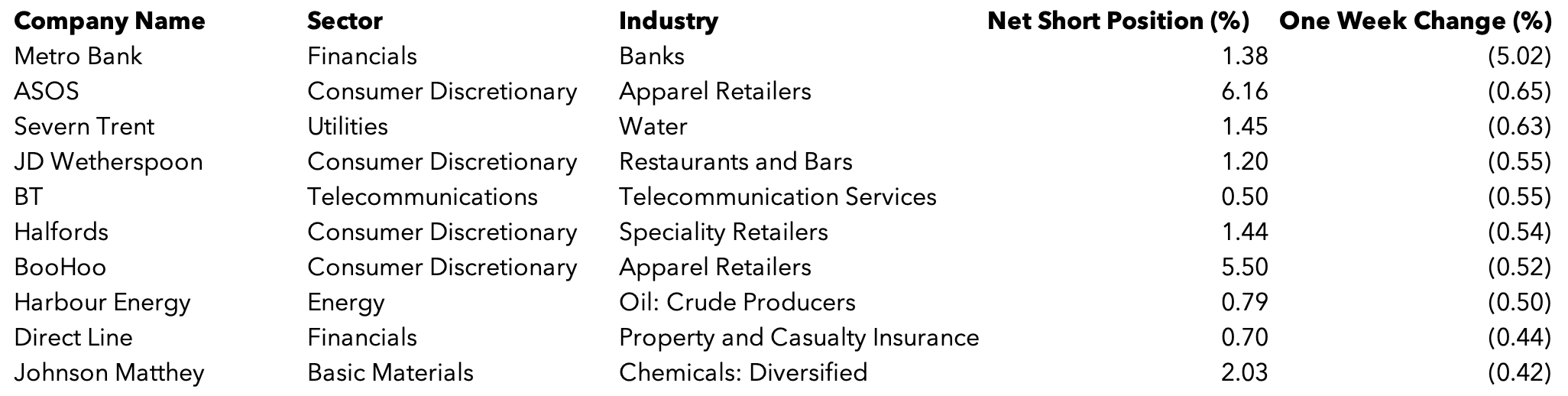

The 10 UK stocks whose net short position declined the most over the last week (or so)

Metro Bank saw the net short position against is collapse. I can’t remember a retreat bigger than this one. Perhaps short sellers have had their fill. This is a company whose shares once traded at 2,196p back in January 2019. Today, they change hands for 39p. Much of that sell off was done by April 2020.

There was an announcement last week (30 November to be exact) that a cost reduction plan that was expected to save £30m in the fourth quarter of 2023 might actually save £50m. Also, it was announced that a £325 capital raise (£150m equity and £175m debt) and a debt refinancing package of £600m worth of existing debt securities was finally complete as the equity placing was signed off on

DISCLAIMER: James J. McCombie owns shares in Kingfisher and Greencore. The Storied Investor has no beneficial ownership position in any of the stocks or securities mentioned. No comment in this article should be construed as a recommendation of, or opinion regarding the future performance of, any stock or security or collection of them mentioned herein. Opinions expressed are the author’s and do not represent the views of The Storied Investor.