The Marks and Spencer (LSE: MKS) share price is up nearly ten percent today following the release of its half year results for the 26 weeks ended 30 September 2023. It must have been a good one. I think it was.

The results were fittingly titled “Reshaping M&S” – Strategy delivers strong results”. Out last article on Marks referenced the multiyear share price decline, flagging sales, shrinking margins and losses. Clearly a turnaround was needed, and after many false starts and a pandemic, it looks like a turnaround is being pulled off with aplomb.

Marks and Spencer posts strong half year results

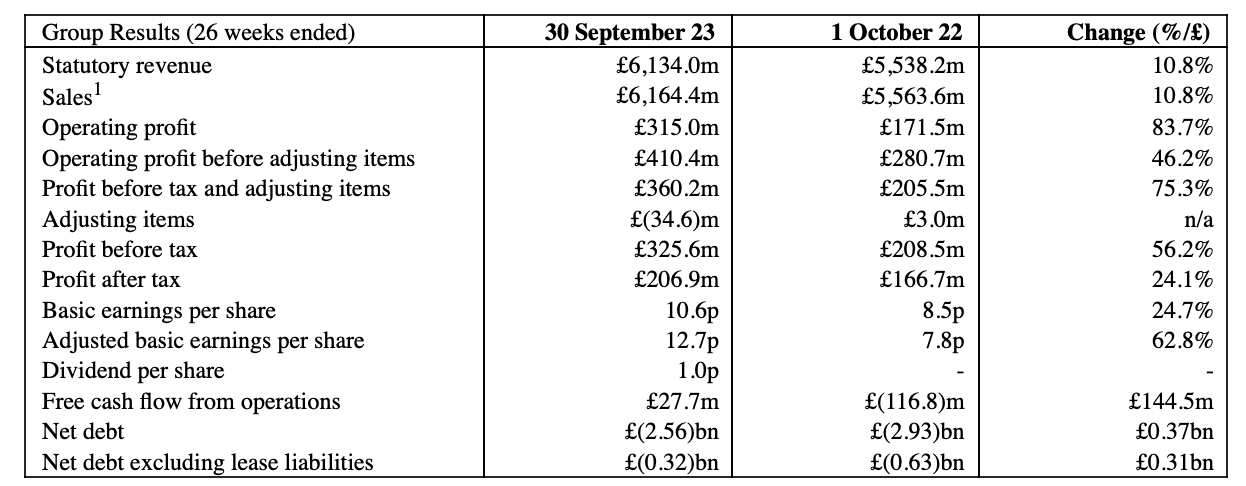

There was a nice summary table in the half year report, which has been reproduced below. Some of these items don’t require much in the way interpretation. From revenue to dividends free cash flow from operations the numbers are higher now then then, which is good. Adjusting items are lower, or more negative, which is probably best considered bad, and we should look at them, but even after deducting them profits are higher.

Net debt levels have gone from negative £2.93bn to negative £2.56bn. Thats confusing as negative net debt suggests you have no debt or at least more cash than debt. Marks does have debt, about £1.0bn in medium term notes and £2.2bn in lease liabilities. But that’s less than the £1.5bn of notes and £2.3bn of lease debt this time last year. It also has more cash (£828.7m now compared to £772.7m last year), but has fewer marketable securities (£21.2m compared to £110.9m then). The bulk of the notes are due on or after June 2025, which is great and overall, net debt has fallen, and that’s a good thing.

Vertical integration of GIST

We are particular interested in how the July 2022 purchase of GIST purchase is working out. We reckoned buying the logistics firm was a good move made at a good price. Marks reckons that the Gist acquisition has delivered £30m of benefits in this half year period.

| 30 September 2023 | 1 October 2022 | |

| Operating Profit Margin | 5.11% | 3.08% |

Overall operating margins are up from 3.08% to 5.11%. That’s not all to do with the acquisition and integration of Gist, but widening margins are, nonetheless, encouraging.

M&S Food looks good

Segmental year-on-year performance strong across the board:

- Food sales up 14.7% with like for like (LFL) sales up 11.7%

- Clothing & Home sales grew 5.7% with LFL sales up 5.5%

- International sales up 3.9% at constant currency

- Ocado retail sales increased 6.9%

This all looks very promising. Digging into the report shows that people are spending more (average basket size increased) and shopping (weekly transactions up) more in M&S Food stores. Clothing & Home showed a similar pattern, particularly online. Ocado Retail, in which Marks holds a 50% interest, and which handles all online M&S Food sales, is still loss making, despite seeing fairly good revenue growth. M&S Bank continues to disappoint, but it is a small operation. Ocado Retail is not.

Marks and Spencer dividend restored

The big new is that a modest dividend will be heading shareholders way. But, they really do mean modest. A 1p per share interim will be paid on 12 January, 2023 with an ex-dividend date of 17 November 2023. At the current share price of 250p per share, and assuming the final dividend is the same, that’s a 0.8% yield.

But, things are moving in the right direction. Holding off on restoring the dividend to anything like its former levels is a good thing. The company is still in the early stages of a multi-year plan to turn its fortunes around. It needs a nice cash buffer. Shareholders will be pleased that a large dividend is not promised and then climbed down from if the company goes through a rough patch. That’s the kind of thing that can really wreck a share price. It’s worse if the company pays out a dividend that it probably should have cancelled. If things continue like this then a plumped up dividend payment shouldn’t be too far away.

DISCLAIMER: James J. McCombie owns shares in Marks and Spencer. The Storied Investor has no beneficial ownership position in any of the stocks or securities mentioned. No comment in this article should be construed as a recommendation of, or opinion regarding the future performance of, any stock or security or collection of them mentioned herein. Opinions expressed are the author’s and do not represent the views of The Storied Investor.