In trading and investing winning positions should be allowed to run and and losing positions should be cut early. But, retail traders in particular, and I would imagine at least some professional ones, do the opposite. Peter Lynch eloquently described this behaviour as “Cutting the flowers and watering the weeds”.

How do I know this? Well, check out the disclaimer on any trading account platform. Most retail traders lose money is what they say, and it’s often the vast majority of accounts. But, I have also looked into this myself.

Trading process

I set up two polls a couple of weeks apart on my account on a popular social trading platform. First I asked this question:

You have a long position in the FTSE 100 and it’s moving in your favour. What type of gain would make you take profit? Do you typically cash in when the position has hit 5%, 10%, 20%, or 50%

Then I posed this question:

You have a long position in the FTSE 100, but the market has been moving against you. At what point do you cut your position and take the loss? When you are down 5%, 10%, 20%, or 50%

After a few weeks I noted the total number of votes for each option, the total number of responses and any comments that had been left for each question.

Cutting winners short

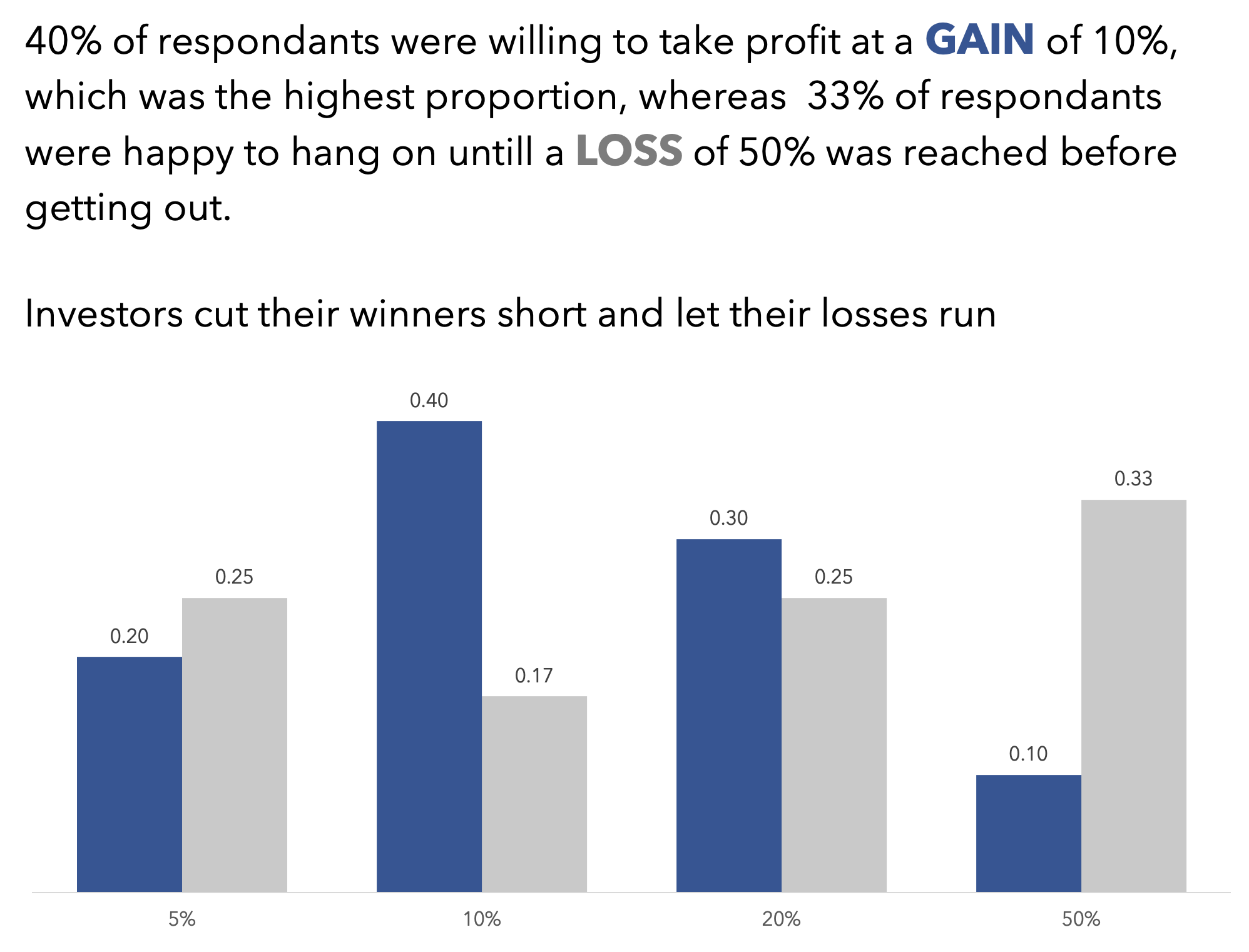

I got 20 responses to the winning long position poll and 36 for the losing long position poll. 40% of respondents would take profits after their long position had hit 10%. 33% of respondents would not cut their losing position until it hit 50%. That is fairly clear evidence of asymmetry, and a predilection to cut the flowers and water the weeds in the retail trading community.

But, let’s not get too excited. This is a small study. Asking the questions separately, rather than getting respondents to answer both was maybe not the right thing to do. But, the findings do seem to confirm what those disclaimers hint at is true, most retail accounts lose money. An easy way to lose money is to make a 20 pence back for every pound you lose.

The comments section below the questions were also interesting. For the wining position, there was just the one comment stating that 100% profit was where they would get out. Under the losing position comment, there were four comments. The losing position question certainly seemed to generate more interest.

Here are the comments:

- Completely depends on where the major support levels are for me.

- dependening on leverage i would buy more. In the long run will be worth much more.

- Depends on leverage, surely.

- 2% max. from whole portfolio amount.

The first comment about support levels seems reasonable. This must be a trader who incorporates technical analysis and is basing buy and sell decisions at least in part on support and resistance levels. The last comment is talking about risk management, and is reasonable again assuming that more than 2% is taken on winners.

As for the comments regarding leverage: If you are down 50%, you are down 50%. we re not discussing percentages of loss before leverage is applied. It is interesting to note that half of the comments indicate leverage is being used. Retail traders are notorious for leveraged risky bets which blow accounts up in short order. The comment about the FTSE 100 being worth more in the long run is interesting as it does indicate a time horizon that is not measured in minutes, hours, or days, although again leverage is mentioned. But, I assumed a long term position would be an un-leveraged one.