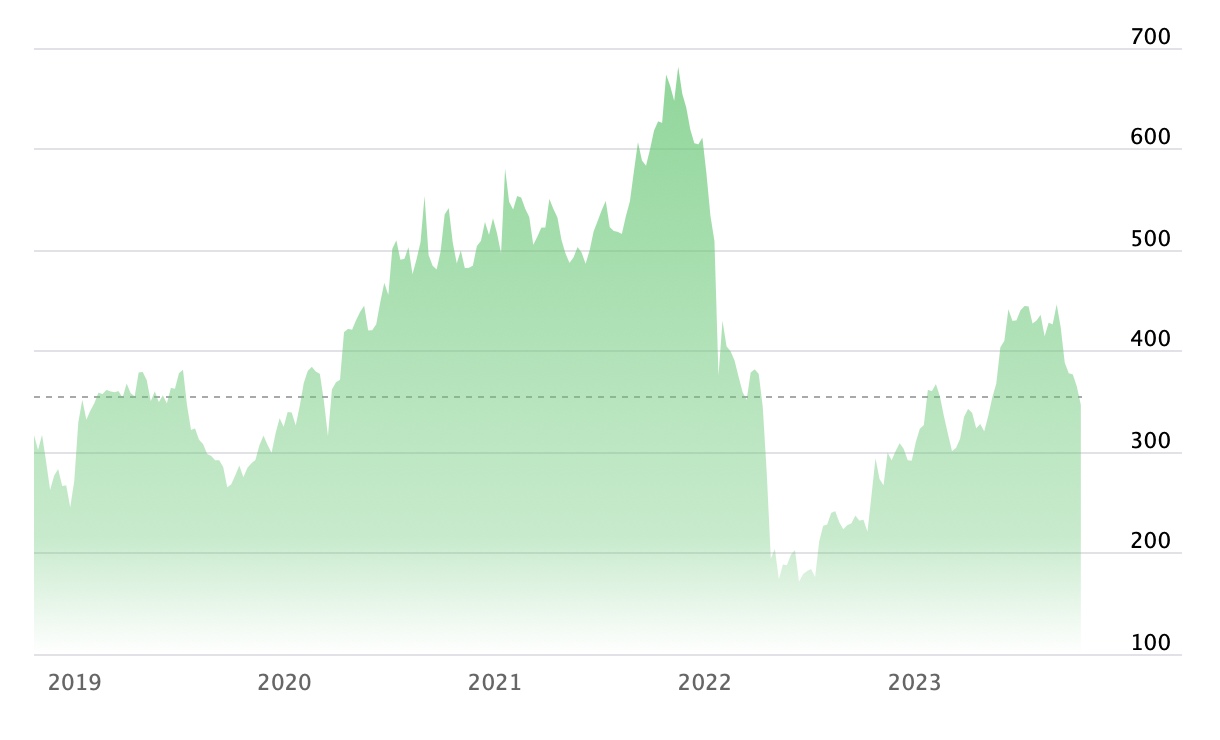

A chart of the Netflix (NASDAQ: NFLX) stock price makes interesting viewing. It went up when other stock prices slumped in March 2020 and beyond as the COVID-19 pandemic swept across the globe. People were stuck indoors, and a Netflix subscription helped ease the boredom.

The Netflix share price declined from late 2021 into early 2022 after the company reported two straight quarters of declining subscribers and revenues. In mid-2022 the price turned around and started to head higher for about a year. But the Netflix share price has come off its summer 2023 high and appears to have broken the uptrend. At around $400 per share right now Netflix shares are worth about what they were worth back in April 2020, and a long way off their $690 pandemic high.

Yesterday, on October 18, 2023, Netflix announced its third-quarter earnings report. In after-hours trading, the company’s share leapt 10% from $346 to $396. That’s a decent pop, and it continued to push higher through the day. It must have been a good quarter.

Subscribing to Netflix

Paying subscribers are the lifeblood of Netflix. The good news for investors is that 8.76m subscribers came on board from July to September. You would have to go back to June 2020, right amid lockdowns, to find a bigger quarterly influx.

More subscribers should mean more revenue, and indeed it did for Netflix. Quarterly revenue grew 4.3% to $8,542 which is an all-time high. Free cash flow (FCF) grew by a stonking 41% from $1,339m to $1,888m.

Top line growth is also finding its way to the bottom line and the number many investors care most about. Diluted earnings per share (EPS) grew 13.1% over the prior quarter to $3.73. That’s a number that has only been bettered once: first quarter of 2021 EPS were $3.75.

Netflix also continued to diversify its customer base across territories. All in all, about 70% of Netflix subscribers now reside outside the US. That’s a good thing.

Passwords and plans

For the longest time, Netflix turned a blind eye to people sharing their account password pretty much with whomever they liked. Things have changed. In April of this year, it stopped allowing people to watch if their location—presumably on an IP address basis—didn’t match that of the main account holders.

Some might have thought this move would be a disaster. But instead of having disgruntled customers cancel, they have either upgraded or the password borrowers have signed up themselves. But what can a customer sign up for? Well, there are Standard with ads, Standard and Premium plans. There is also a basic plan which sits between standard with ads and standard according to Netflix, or at the bottom, depending on your point of view. But you can’t sign up for that anymore, but existing users can continue to subscribe.

FUN FACT – suprisingly, some US residents might still have DVDs that they rented from Netflix. But the 25 year old DVD business is closing. The last discs were shipped in their red letters on the 29 September, 2023. Once they are returned, or lost down the back of the sofa, its over.

Netflix press release 18 April, 2023

The plans differ in price (obviously) and you pay more to watch on more devices simultaneously, in better quality, and view more content as the ad-supported plan makes some movies and TV shows unavailable. Additionally, the Standard and premium plans allow one or two members to watch who don’t share a home with the account holder. Apparently, you can still go on holiday and watch without issue. Hmmm.

So, driving password borrowers to their own account or forcing an upgrade is helping subscriptions and revenues. Adding ad revenue is another means of driving revenue higher. The ads plan is the cheapest in most territories and probably tempted the password sharers in when the sharing game was up. Ads were introduced in November 2022, not too long before that password-sharing crackdown.

How much do you pay for Netflix?

UK readers will be interested to learn that the price for a standard subscription is increasing by £1 to £7.99 a month, and the premium option is going up by £2 to £17.99. In the States, the premium service is going up by $3 to $22.99. Users in France will be paying €2 more for premium from now on.

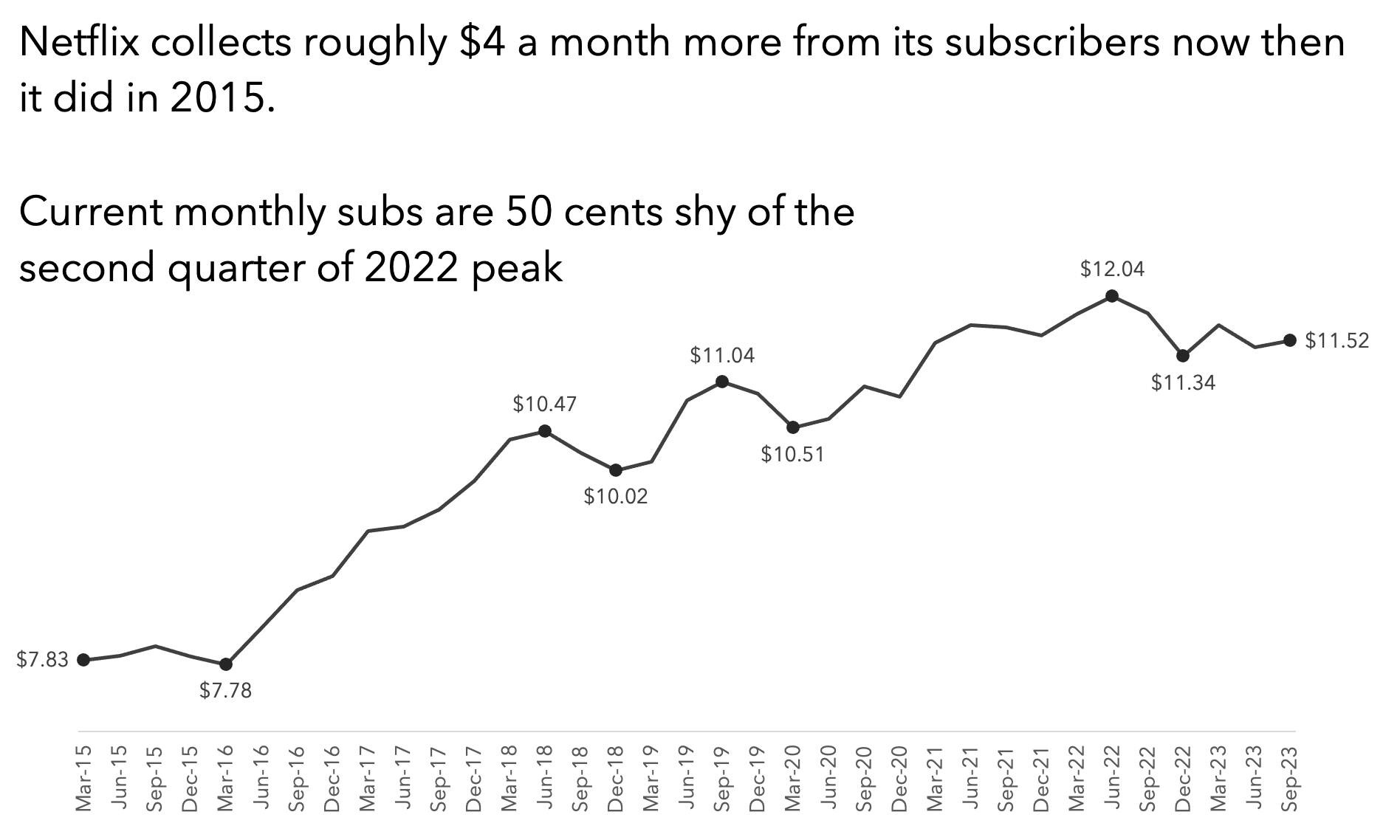

Price hikes like this have always been a thing with Netflix. The company has been pretty good at getting customers to pay a little more per month over the years. The average subscriber paid $7.83 a month in early 2015. Now they pay $11.52.

When you combine a growing subscriber base with incremental subscription price rises then you have a recipe for success. And so far, Netflix has been a success. Investors probably got ahead of themselves during the pandemic. But, if the company carries on like this then there is every chance of hitting those highs again.

Where is the Netflix stock price going?

Netflix is in a strong position as a streaming service. As of September 2023, it commanded 7.8% of streaming screen time in the US according to Nielsen, a market measuring firm. Only YouTube does better with 9%. Other streaming services like Prime Video, Hulu and Disney fall well short on 3.6%, 3.6% and 1.9% respectively. Also, unlike other streamers like Disney, Netflix is not posting big losses: as already discussed its third-quarter earnings report was pretty damn good.

Ad revenue is new, and getting a handle on its potential will take time. But YouTube and Netflix are unmatched in streaming in terms of the potential of getting ads in front of eyeballs. Those cheaper plans could end up being decent earners both in terms of ads and getting previous password borrowers to sign up.

But there are always concerns. Content is king for streamers. Content is getting more expensive to make and license. Amongst other factors, the deal to end the writers’ strike could add $68m a year to Netflix’s expenses. However, the subscription pricing increases seem to have dealt with that and then some.

But the bill to settle the SAG-AFTRA (the actors) strike is still unknown. They want higher pay and more problematic for the streamers is an ask for residuals for re-runs and premiers on their services. The actors are also seeking assurances over the use of their image and voice in the age of AI, so studios and streamers won’t be able to turn to technology to garner A-list draw without A-list prices.

The strikes have choked the pipeline for US content. Netflix might have to rely on foreign productions and its back catalogue to keep users interested until the cameras start rolling again in Hollywood. Will it lose subscribers interest and direct debits? Possibly, but its fall and winter release schedule looks strong. But, then again that third quarter report is a little light on detail for next years release schedule.

So long as Netflix can keep increasing prices—I think annual raises will become a thing—without scaring away subscribers, then it should be able to keep paying for the content that is needed to keep subscribers interested in the first place. Mobile phone contracts increase every year with inflation, so there is precedent. But a phone is probably more essential than a Netflix subscription, and many people need the former to make the latter worthwhile.

DISCLAIMER: James J. McCombie does not own any of the shares mentioned. The Storied Investor has no beneficial ownership position in any of the stocks or securities mentioned. No comment in this article should be construed as a recommendation of, or opinion regarding the future performance of, any stock or security or collection of them mentioned herein. Opinions expressed are the author’s and do not represent the views of The Storied Investor.