Its been a rough year for UK stock markets. Most indices, including the flagship FTSE 100 are underwater. But as markets and indices decline, there are usually some stocks, and sometimes entire sectors that buck the trend.

In this article we will look at the performance of quality, value and growth factors over the last three and one months. The various industry groups and sectors will get the same treatment.

Growth, Value and Quality stock factors

All stocks in the FTSE 100 and FTSE 250 were included. Each stock had a quality, value and growth rank computed. This was done by taking a few key metrics for each factor, for example the price-to-earnings (P/E) ratio for value, return on capital employed (ROCE) for Quality, and sales growth for growth. The metrics were equally weighted for each stock to produce a composite score. For each factor percentiles were created for the composite scores with the best scoring stock rated as 100 and the lowest as one.

The average UK stock returned 0.04% over the last month, but has lost 3.38% over three months. In the tables below, the comparison is with the average stock. Blue shading is better than average and red below average.

Value

There is a big problem with looking at performance compared to current value rank. A value rank takes things such as P/E ratios into account. P/E ratios change with a stocks price. So a strongly performing stock might have drifted from a lower P/E ratio to a higher one over the time frame under study.

With that out of the way, over the last three months the lower the value score, or more “expensive” stocks, performed better than “cheaper” ones. Over the last month, the picture is a lot more muddled.

Quality

Higher quality stocks performed better than low quality stocks over the last three months and also over the last month.

That’s reassuring for me as I do lean towards quality in my portfolio.

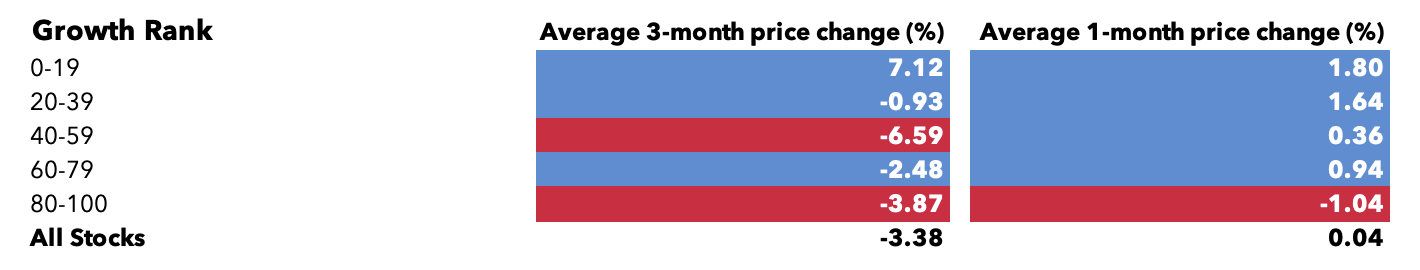

Growth

High growth stocks have been out of favour for the last one and three months.

Lower growth stocks have done relatively well over both time frames, with the lowest ranking growth stocks posting respectable gains.

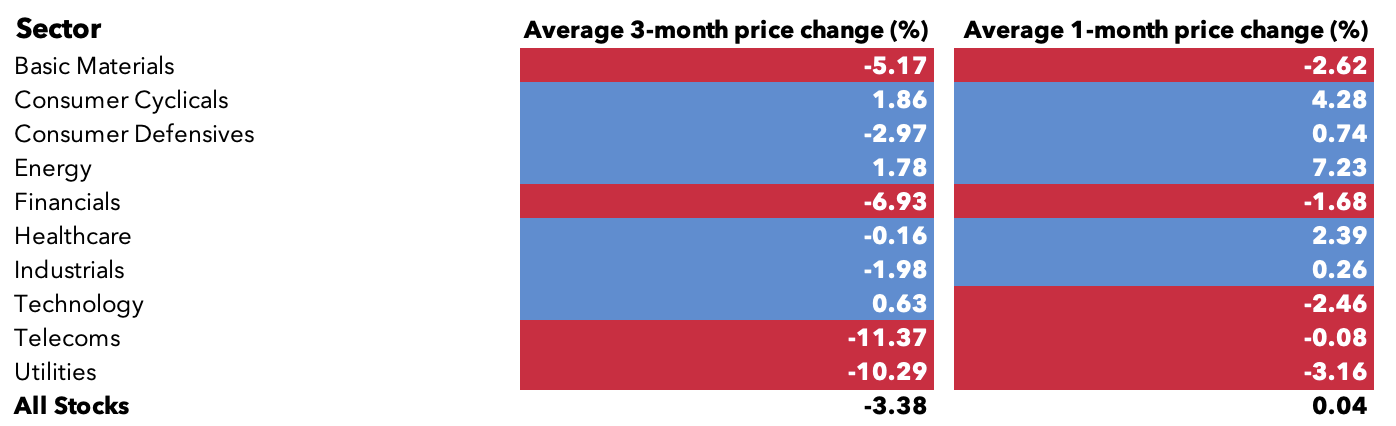

Sector

Over the last 3 months the average stock in the consumer cyclicals, consumer defensives, energy, healthcare, industrials and technology sectors has outperformed. Telecoms, utilities, financials and basic materials stocks have underperformed on average.

The consumer cyclicals, energy and technology sectors are the only ones to register a positive average gain.

The story is pretty much same for the last month, except that technology stocks join the under performers group. Also, all outperforming sectors registered a gain over the last month. Energy and consumer cyclical stocks performed strongly registering a gains of 7.28% and 4.28% respectively on average.

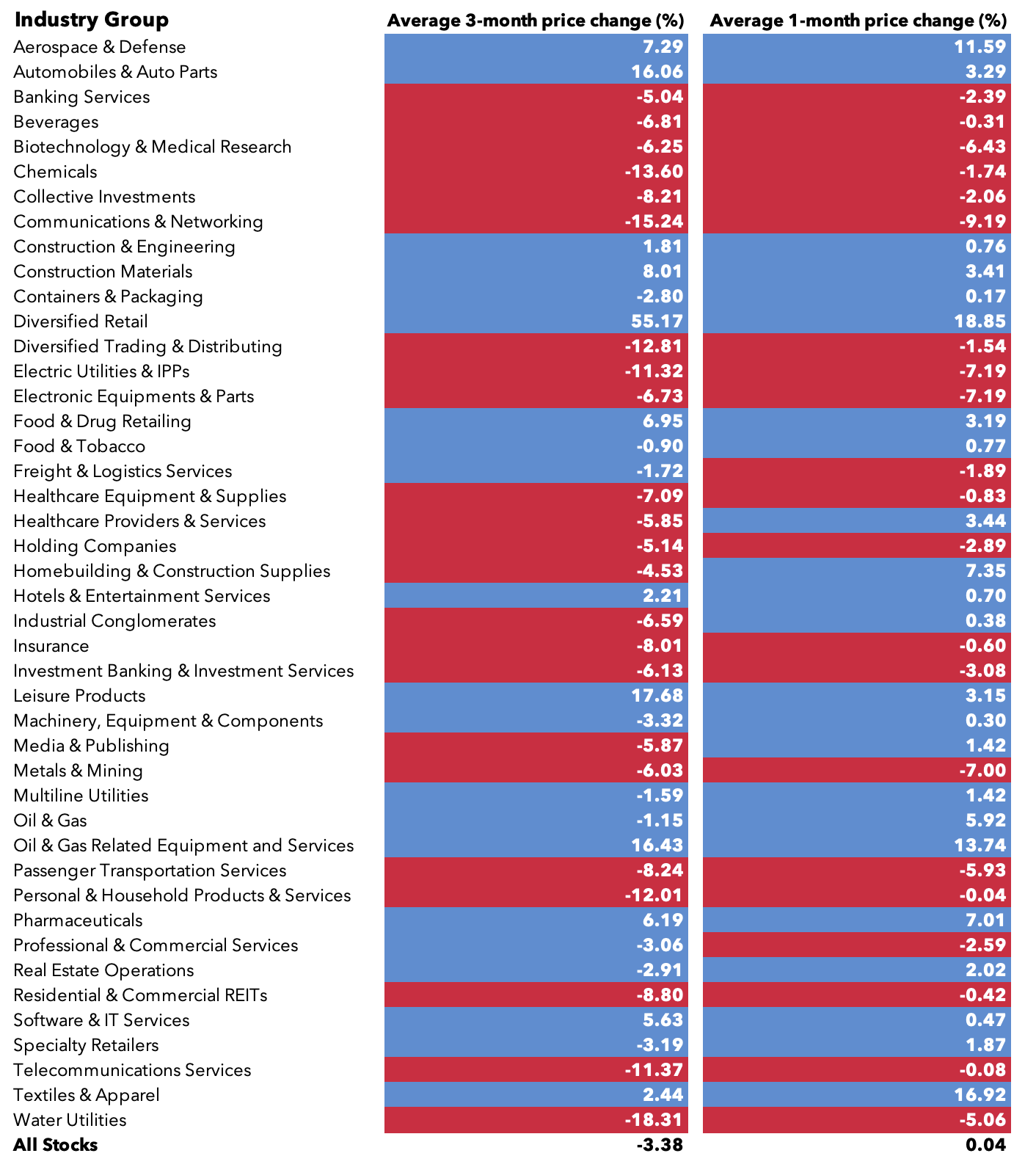

Industry Group

Finally, there are the various industry groups. There are so many that picking one or two out is pointless. Leave readers with the table to draw their own conclusions.

DISCLAIMER: James J. McCombie does not own any of the shares mentioned. The Storied Investor has no beneficial ownership position in any of the stocks or securities mentioned. No comment in this article should be construed as a recommendation of, or opinion regarding the future performance of, any stock or security or collection of them mentioned herein. Opinions expressed are the author’s and do not represent the views of The Storied Investor.