I am sure readers will be aware of the dispute between Nigel Farage and NatWest. A new twist in the tale has hit traditional and social media today. But before we get to that, it’s worth summarising the events so far.

Timeline of events

Mr Farage released a video on Twitter on 29 June 2023 claiming that an unknown commercial bank had informed him a few months prior that it was closing his account. The decision was said to be commercial but was suspected by the account holder of being more to do with his status as a “politically-exposed person” (PEP).

On 4 July, 2023, the BBCs business editor, Simon Jacks, reported that a source had told him that Mr Farage’s account at Coutts, which is a subsidiary of NatWest, had been closed because he fell below financial thresholds. The source was suspected to be the CEO of NatWest, Alison Rose, who Mr Jacks had been seen talking with the previous evening at a charity dinner. Mr Farage confirmed that the unknown commercial bank was indeed Coutts.

On 18 July, 2023 Mr Farage reveals that he had obtained documents from the Coutts repetitional risk committee via a subject data access request detailing the thinking behind the decision to end his relationship with the bank. The full documentary bundle was published in the Daily Mail the next day and included in this article.

The documents do reveal that Mr Farage was on a path to falling below financial thresholds for an account because a mortgage he held with them was due to expire. But they also included pages and pages of material gathered to asses whether he was a reputational risk, and gives the timing of the decision to exit his relationship as 13 March, 2023.

On the same day that the documents were published, Kevin Craig GB News produced his mobile phone to read an email he had received from the Coutts CEO. The email said that Mr Farage was on record as admitting that Coutts offered NatWest accounts to meet his needs. Mr Farage would dispute this as he said the offer only came after he went public, and that the NatWest accounts offered were personal not business accounts, which would not meet his needs.

The BBC later amended its story on 21, July 2023 and issued a personal apology to Mr Farage a few days later. Ms Rose admitted she was the BBC’s source and apologised for a “serious error of judgement”. The board of NatWest said they had full confidence in Ms Rose. On the 26 July, 2023 Ms Rose stepped down.

NatWest share price drop

Today, the CEO of Coutts has also stepped down. And there has been another development. I first noticed this after seeing a tweet (or is it an X) from an account called The London Economic. It included a picture of Nigel Farage, and accused the owner of GB News of taking a short position against NatWest, using his news channel to whip up outrage against bank over its handling of a GB News presenter, causing the stock to fall by £850m, and then exiting the trade.

Now The London Economic got its information from other media sources and then produced a titillating tweet. This tweet has gotten a lot of engagement. The tweet suggests a coordinated action. We think it is misleading. And, since we regularly publish information on short positions against UK stocks, I think we are in a good position to examine some of the claims made in greater detail.

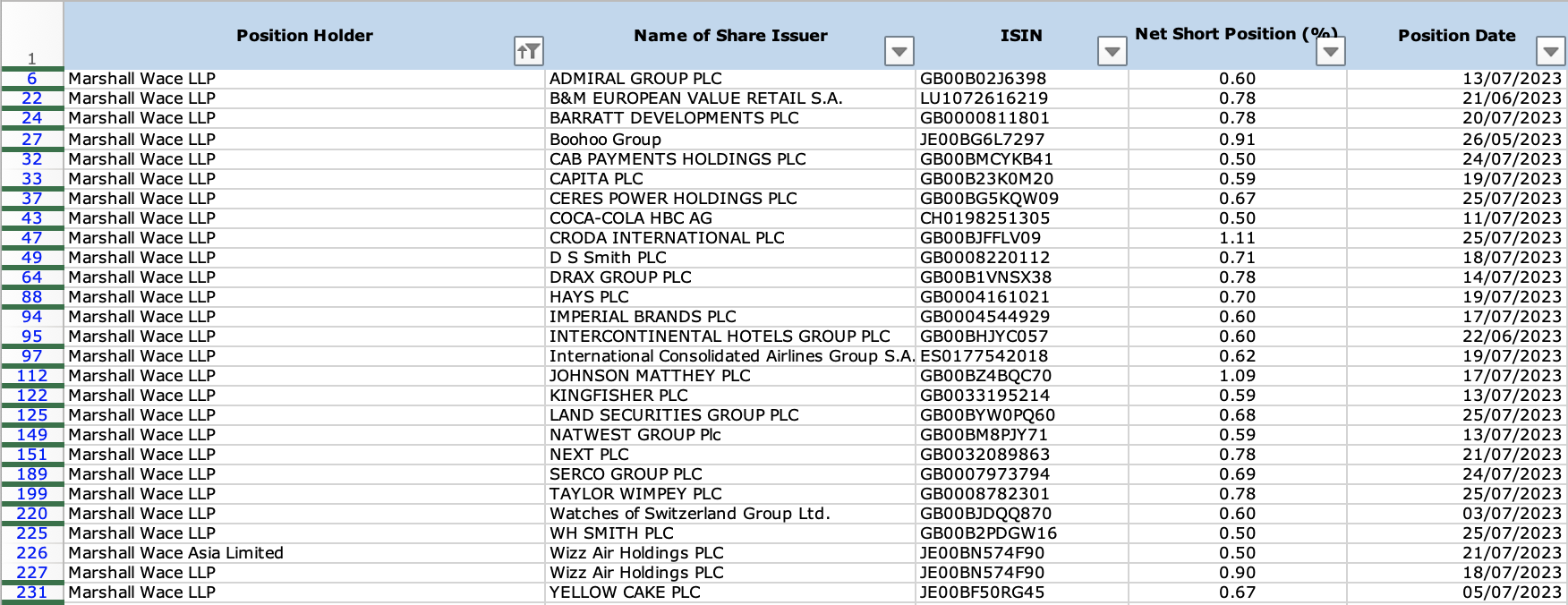

There are further details on the London Economic position in an article on its website. It says that regulatory fillings were ‘unearthed’ by the Telegraph showing Marshall Wace, a hedge fund indeed associated with the GB News owner, had a short position against NatWest stock. But, The FCA’s short sellers report is easy to download by anybody, we do it every week, so it needing to be unearthed is a bit of a stretch.

The £850m figure was lifted straight from the Telegraph article. They used it to refer to the drop in market capitalisation of the stock following Ms Rose’s departure. The part about the hedge fund making £5m in paper gains, was also lifted, as was the disclaimer about the fund using algorithmic trading, and the position being a small part of a larger portfolio. The speculation about it all being a bit too convenient was The London Economic’s own work.

Marshall Wace shorting NatWest shares

First up let’s examine the claim that Marshall Wace exited its net short position against NatWest shares. According to yesterdays FCA short sellers report it still held one, it was last modified on 13 July, 2023, but still remains current.

Next up is the suggestion that Marshall Wace took the position and then orchestrated a media frenzy intended to drive out the CEO and cause a share price slide. Well, Marshall Wace held a short position against NatWest as far back as 2016. It looks like it got out, but then was back in July 2022. The position increased in size until 7 June when it starts to decline.

Now, Coutts made the decision to begin the termination of Mr Farage’s account on 13 March 2023. Mr Farage would have been informed later and went public on 29 June, 2023. If this was orchestrated, as The London Economic suggests, then Marshall Wace knew about the termination of Mr Farage’s account before he did. Then they trimmed their position before he went public and went on to “whip up outrage” despite not naming the bank himself.

How about the £850 million claim. Well, the The Telegraph said that was the result of Ms Rose’s departure. The NatWest share price closed at 251p the day before and 242p the day after. There are some 10bn shares in issue, which means the market cap dropped by about £903m according to my calculations. Fair enough. But the London Economic suggests this was the drop resulting from the media storm. It wasn’t. You’d have to go back to 29 June, 2023 to measure that if it existed, since that was when Mr Farage made his announcement that an unnamed bank had closed his accounts for reasons he speculated were not purely commercial.

The NatWest share price closed at 234p on 28 June 2023. So its market cap has increased by £500m since then. That is not a good for a short seller like Marshall Wace. The Telegraph reports the hedge fund made a £5m paper profit on the day Ms Rose departed. Given it has trimmed its short exposure since the end of June, it’s probably sitting on a paper loss on this position since the story broke. I think that’s important to mention.

If we go all the way back to 8 July, 2022, when Marshall Wace looks like it started building its short position against NatWest, the banks shares were worth about 220p. It has increased its market capitalisation by £1,906m since then which is not good at all for someone betting against a price drop.

What’s the problem?

Ultimately this whole issue boils down to a couple of points. Forget the personalities involved, and whether you like them or not. First, although banks have a duty to ensure their clients, especially politically exposed persons, are not involved in money laundering, corruption, or other crimes, do we think it is right for them to deny accounts to people because they don’t agree with the things they say?

Second. Do we think it’s right for the CEO of a major bank to discuss confidential client information with journalists over dinner or email, or whatever method of communication you can think of?

Third. When reporting on events, fairness matters. Opinions are welcome, but should be stated as such. If opinions are presented as facts, then evidence should be produced. And that evidence should be presented in full, not cherry picked, and not twisted to suit whatever theory is favoured. Looking from a different perspective, taking the counter argument can be illuminating. It might rubbish the theory but it might also show its strength.

As it stands there is no evidence to suggest that Marshall Wace conspired with Nigel Farage to profit from bringing down the price of NatWest shares. So I am happy with the headline of this article. To make such an assertion, or suggest it, would require some evidence beyond appeals to coincidence and speculation.

DISCLAIMER: James J. McCombie does not one any of the shares mentioned. The Storied Investor has no beneficial ownership position in any of the stocks or securities mentioned. No comment in this article should be construed as a recommendation of, or opinion regarding the future performance of, any stock or security or collection of them mentioned herein. Opinions expressed are the author’s and do not represent the views of The Storied Investor.