A while ago we identified seven quality stocks that very U.K. investor should know about. AJ Bell (LSE: AJB) was one of those stocks. We like quality here at The Storied Investor, but what exactly is quality. Well, one way of defining it is to look at various metrics that are indicative of quality like we did when we identified seven quality stocks. This is a quantitative approach.

Another way is to look at the business model and see if it has any quality characteristics or patterns. This would be a qualitative approach. In practice, both approaches would be carried out at near the same time. So, we have had a quick look at the numbers, now let’s explore the narrative. What exactly are those fundamental things that AJ Bell needs to do well to succeed.

Investing platforms

In the world of finance, a platform sits between an investor the account holding their assets. AJ Bell provides platforms (and accounts) for retail (direct-to-consumer (D2C)) customers and for advisors who help manage assets on behalf of their clients.

So, there’s one thing AJ Bell has to do well. Provide platforms that are its customers love to use to manage their assets. AJ Bell traditionally has two platform offerings, one for retail and one for advised. They were, and are, designed for desktop use and loaded with features. Well, AJ Bell now has simplified proportions in TOUCH for advisors and Dodl for retail customers which are also better suited to use on mobiles and tablets.

A range of offerings is a good thing. Perhaps some find the bells and whistle platforms daunting or used just a fraction of the services and options on offer making them feel unnecessary cluttered and difficult to navigate with no benefit. Or perhaps not. Either way, for too long AJ Bell didn’t segment its market at all. Now it does.

How AJ Bell makes money

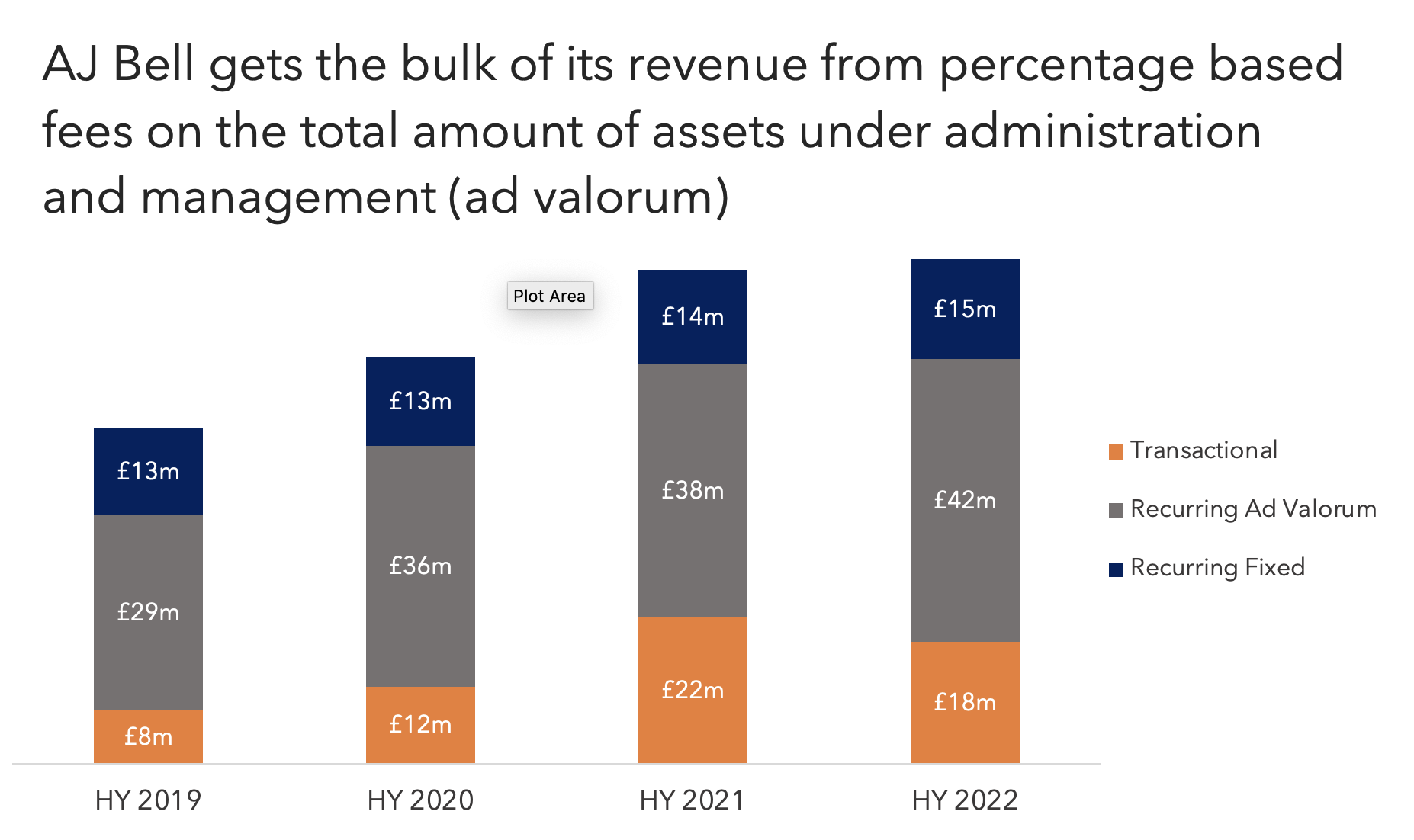

AJ Bell collects variable fees based on the value of assets held in its accounts under administration and management. These are referred to as recurring ad valorem fees. It also, collects dealing charges when customers make trades, and adds FX commissions if the trades are in foreign assets. These are termed transactional fees. There are also recurring fixed fees for things like pension administration and content and data subscription charges from AJ Bell’s media wing.

The most important revenue source are those ad valorem fees. And the biggest driver is assets under administration, although assets under management are becoming increasingly important. Assets under administration (AUA) are all those stocks & shares and funds held in AJ Bell ISA, SIPP and general investment accounts. Higher AUA means higher revenues.

How does AJ Bell grow its AUA then? Well it can:

- Attract new customers that are not currently using any platform to investing accounts

- Convince someone else’s customers to transfer their assets to AJ Bell accounts

- Encourage regular investment from existing customers

- Hope that markets move higher, increasing the value of all assets

The first two points can be achieved in part by a combination of increasing awareness of the AJ Bell brand, and offering competitive rates and features. On the brand awareness front, AJ Bell has made progress over the years. However, it remains significantly less well known than the most well known platform provider: Hargreaves Lansdown.

Also, it helps if people feel able to save for the future. That requires them to have something left over at the end of the month. Now, that doesn’t just apply to the regular savers, bit also new investors thinking of setting up an ISA for the first time. Markets moving higher is out of AJ Bell’s hands, but it does drive fees. Having a component of revenue being driven by something that has been described as a random walk can be a problem, particularly during downturns. But, although AJ Bell customers do tend to trade move when market volatility is high, their customer base is a lot more long term thinking than some of the other trading and investment platforms that have hit the headlines over the last couple of years or so.

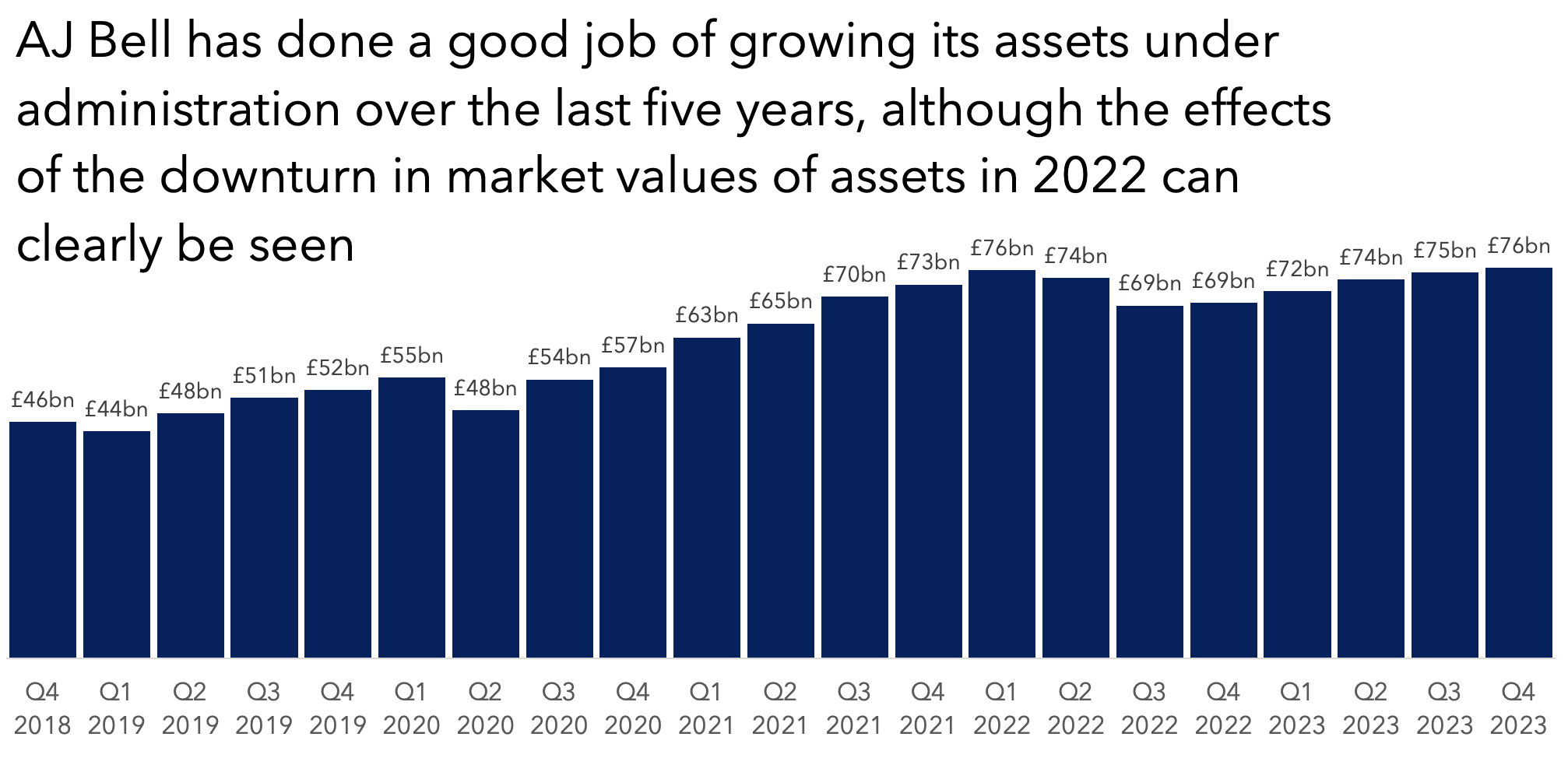

The AJ Bell stock price should grow with AUA growth

AJ Bell has grown its assets significantly over the last five years. It gets its face in front of potential customers by advertising, unsurprisingly, but also sending expert employees to do interviews, and pop up on websites taking about savings and investment, tax matters and the like. There was a blip in AUA growth in 2022 as markets values tumbled, and perhaps some customers pulled money out of accounts, but since them AUA have recovered.

Customer numbers have increased from 198k in the fourth quarter of fiscal year 2018 to 491k in the fourth quarter of fiscal year 2023. At the same time average account size has fallen from £232k to £154k, in a steady trend that cannot be laid at the door of the markets turning sour last year. I think thats a good sign. I take it as meaning that newer accounts (probably ISAs), held by younger people, with smaller total assets bases are coming on board. Hopefully they will stick around, providing an increasing fee base for decades to come.

AJ Bell has a long way to go to approach Hargreaves Lansdown’s size. That company has 1.8m active customers, around 4 times as many as AJ Bell. But its total AUA are only around twice as large as AJ Bell’s at £134bn. That gives an average account size of £74k, significantly lower than AJ Bell’s. I think that speaks to AJ Bells history as a bespoke SIPP provider, who later moved into ISAs, which tend to be smaller .But the move was needed, many people still have defined benefit plans, like public sector workers, which are outside the platform providers purview. Others have defined contribution plans with their employers, but don’t have much choice on the provider. The growth is in ISA accounts rather than SIPPs, as the later have limited use cases. Everybody can open them in addition to pensions, they are more flexible than pension accounts, and have tax shields (albeit different to SIPPS).

To conclude, I am willing to bet the future will be good AJ Bells AUA. It is doing a good job of doing things that will promote AUA growth from its end. Asset prices seem to be doing ok, folks are predicting a peak in the interest rate cycle is coming soon (ish). That should encourage savings, and I think disposable incomes are not as squeezed as claimed, at least amongst those that have a proclivity to invest in things like ISAs.