Last month I wrote about the top performing UK stocks of each year in the last decade. One of the top performers, Ocado, has already had its winning 2013 return analysed. Now it’s time for the Games Workshop share price’s extraordinary 2017 return of 314%.

Some old ground is going to be retrodden here. An article already exists on this site about Games Workshop and its performance after it announced that it had reached a deal with Amazon for the rights to produce content based in its Warhammer intellectual property. Whilst writing that article it became apparent that something special happened to the company in 2017. But here is a chance in fresh and focused article to explore and expound a little more on what

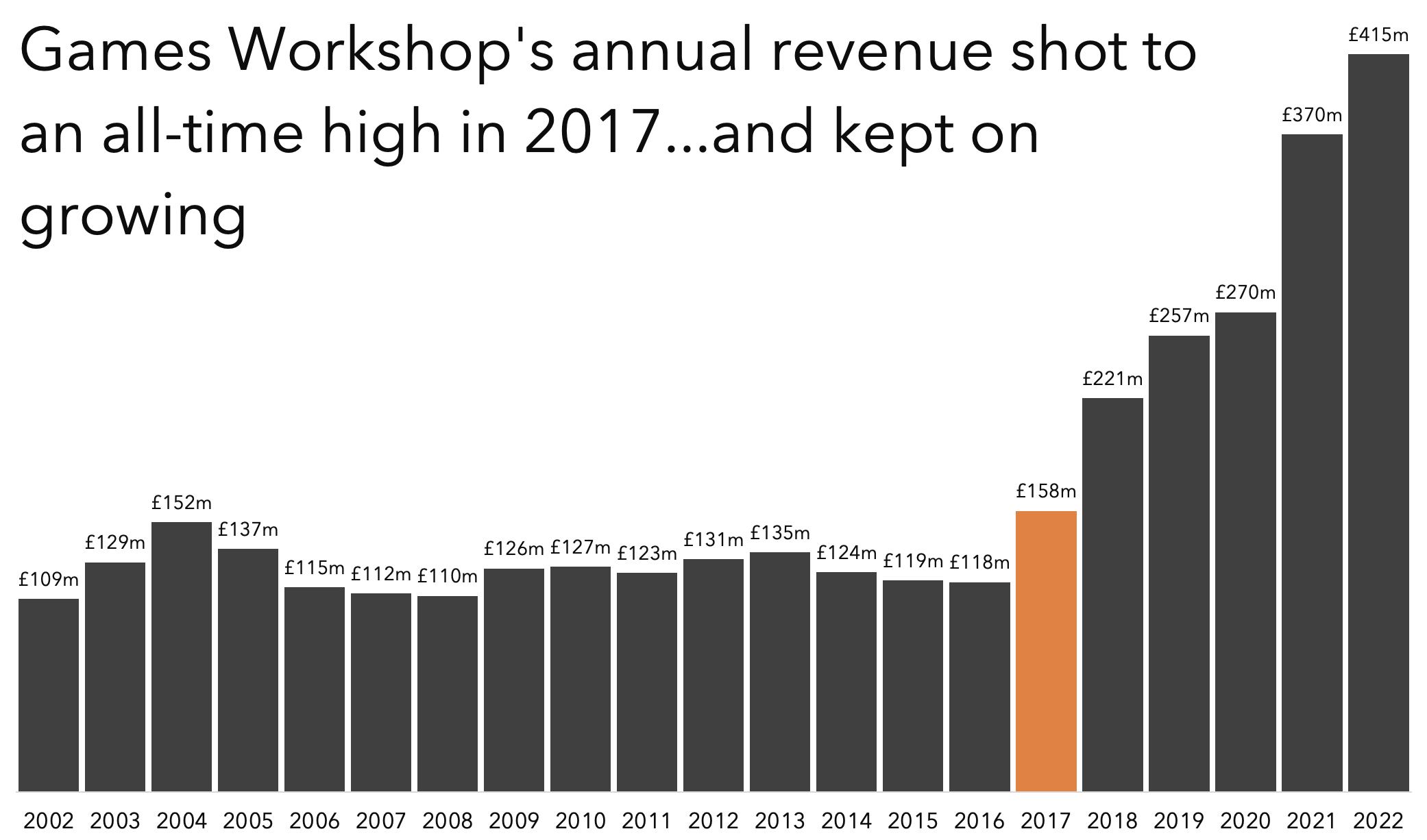

Games Workshop’s reported revenue spiked in 2017

A glance at the annual numbers for Games Workshop reveals that its annual revenue leapt from £118m in 2016 to £158m in 2017, and it kept on growing. Job done then. That’s why the Games Workshop share price rocketed in 2017. Hold on though, although something clearly happened around this time, this company did not release its financial year 2017 (which ended in May 2017) numbers until July 2017.

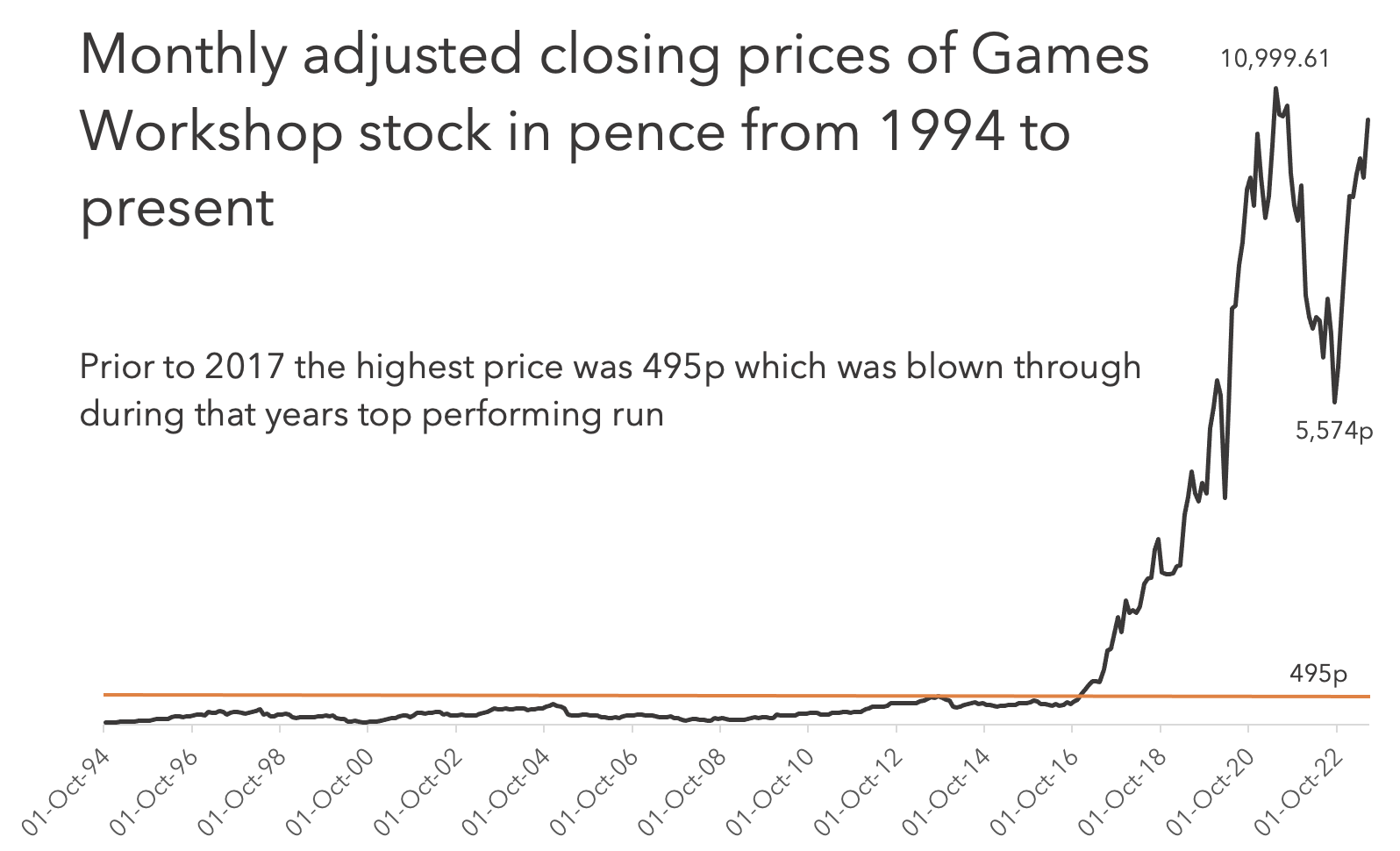

The run up in the company’s share price started before the mid-point of 2017. It came off a low and and started to move higher in mid-2016, and kept going through a previous high of 482p sometime in late 2016, based on looking at a monthly price chart.

Drilling down to a weekly price chart and yes, its definitely right at the end of 2016 and going into 2017 that that old high gets broken, and then the share price keeps on going. There are a number of either annual reports, interim reports or trading updates that were released around those dates, that seem to coincide with price jumps or accelerations of the upwards trend in the Games Workshop share price.

There was a major change at the top in 2015. Right at the start of the year Kevin Rountree was appointed as CEO. He joined the company in 1998 as assistant group accountant, moving through various mid-management roles until landing the job of CFO in 2008 and COO in 2011 before taking the top job as CEO.

He inherited The Great Master Plan: cutting costs, becoming more efficient, providing excellent returns on capital and paying dividends. Part of the plan to cut costs and become more efficient was getting getting Games Workshop stores out of expensive locations, sliming their stock offering to new releases and tailored extended ranges and making a lot of them streamlined enough to be managed by a single, engaged and motivated member of staff.

He also green-lit the rebranding of stores to “Warhammer” to match what customers called them. And his early tenure was also marked by increased efforts to market the company via social media, better recruitment and training practices, and open more trade stockist accounts. These are responsible for Games Workshops trade, or third party revenues, which are sales from non-company owned stores.

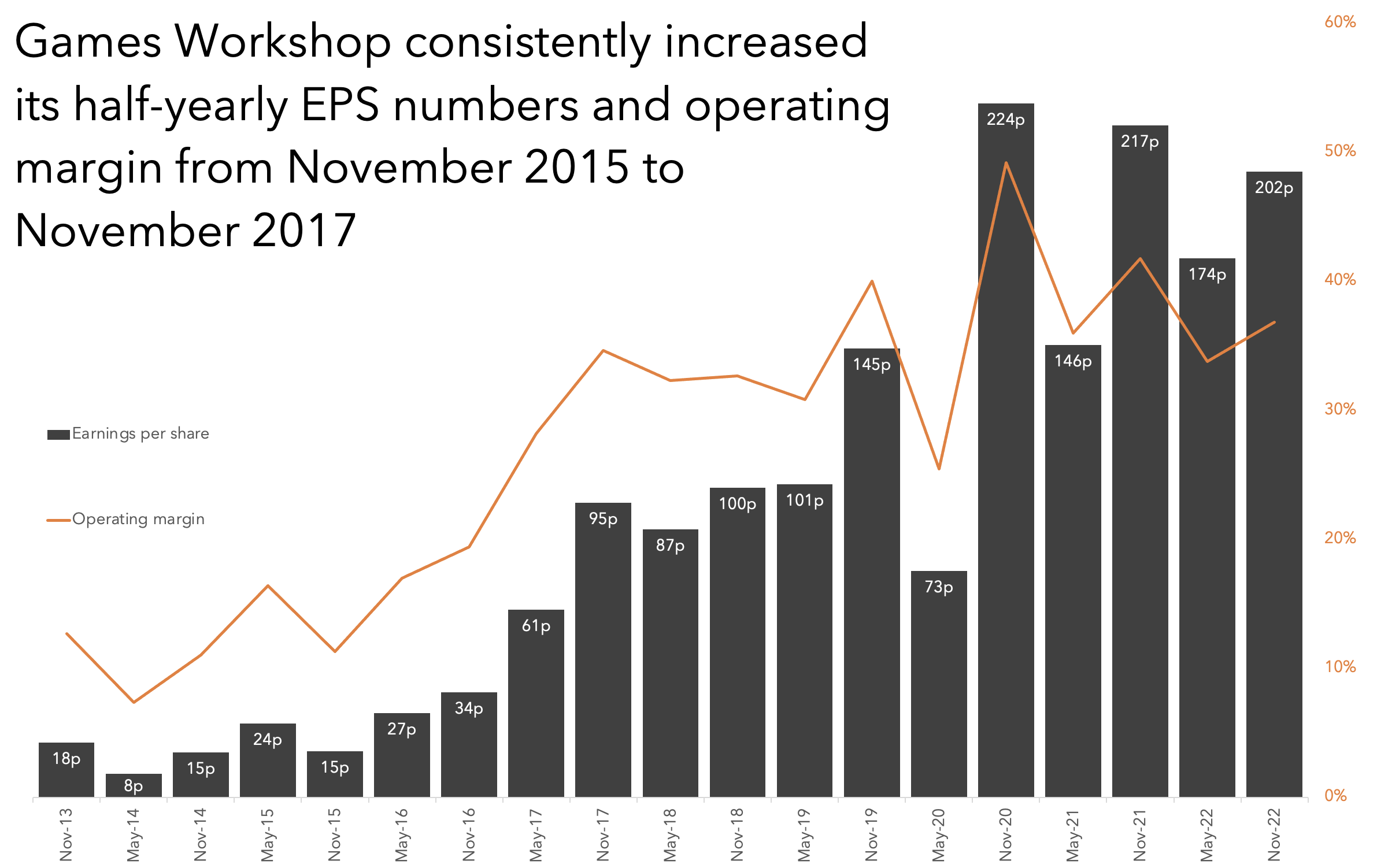

There was also an effort to fully capitalise on licensing the companies intellectual property to others to develop into games and TV shows for example. And, in July 2015 there was a new Warhammer release: Warhammer: Age of Sigma. Now, all these strategic moves sounded positive for revenue and margins. But, although margins, as we shall see later did start to improve from May-2014 onwards, revenues remained stubbornly range bound. And despite the company’s best efforts to communicate that their plans were working, shareholders were still not enthused enough to lift the Games Workshop share price out of the doldrums. At least until after mid-2016.

A leg up from Stranger Things

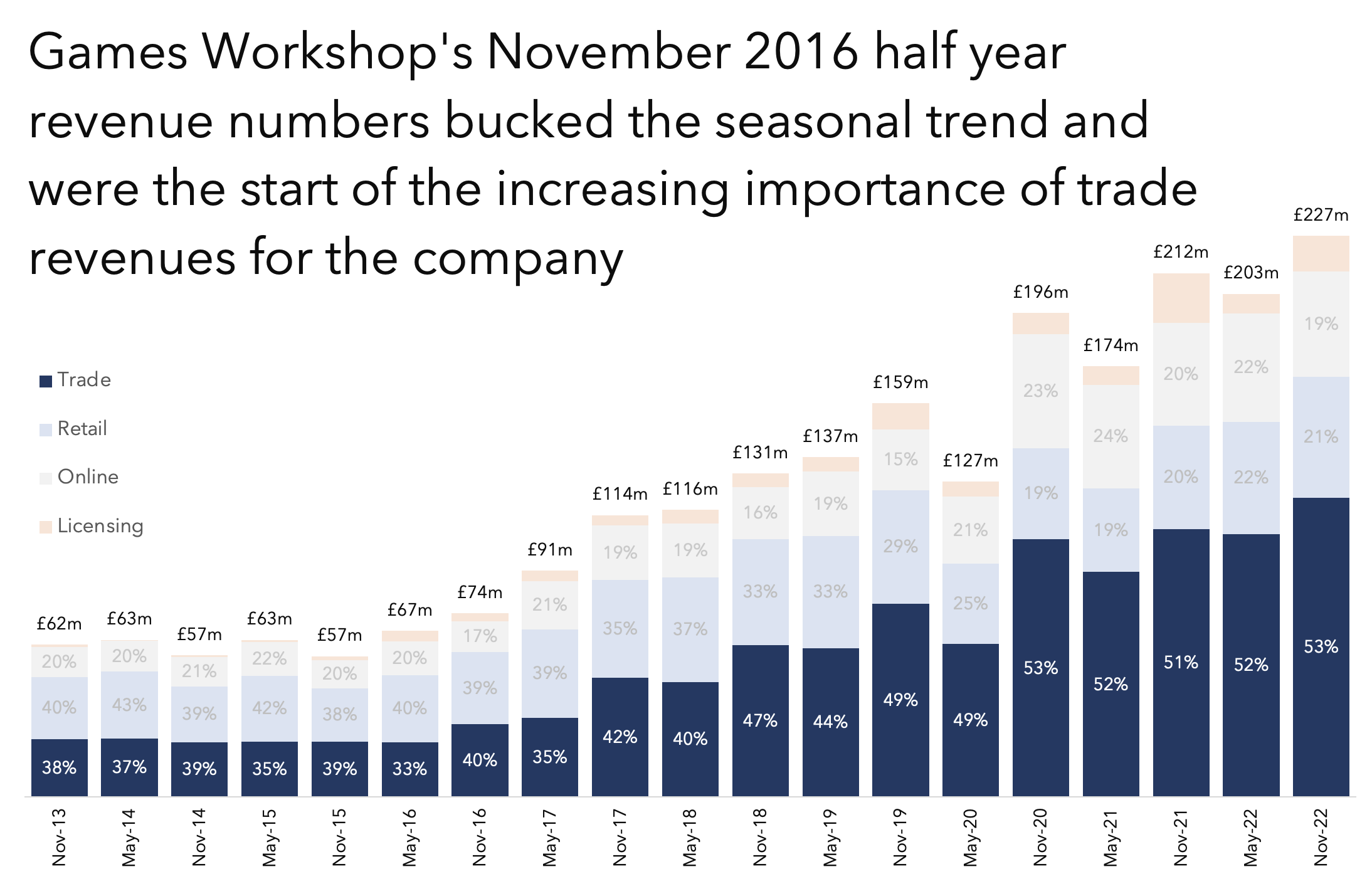

I think the decision to expand the trade channel was crucial to the companies success. If we look at half yearly revenue numbers, what stands out is the percentage share of revenue from the trade channel starts to grow in in the half year leading up to November 2016. But again, these results were not known to investors until later, so cannot explain the change in sentiment I think is seen in the middle of that year, although there were suggestions this was happening in the trading update released just before the rise from 312p started.

But something else was happening in 2016, and I remain convinced this had something to do with Games Workshops meteoric rise the following year: Stranger Things was released. That is a show about the exploits of a group teenagers that happened to love table top role playing games. Yes, it was D&D in the show, but Games Workshop makes miniatures for its own TTRPG world alongside other means of promoting it.

A canny investor looking watching the buzz around that show how and thinking this will make this kind of thing cool again, or at least drive interest in it up, would surely have looked at games workshop and had a change of heart if it needed changing. Miniature painting, and TTRPGs had been niche activities, very much enjoyed in small circles. But YouTube and the like enabled larger communities to be nurtured and grown. But I think Stranger Things really lit the fuse.

A lucky roll of the dice?

I don’t mean to suggest that Games Workshop simply got lucky. From reading the strategic report sections authored by Kevin Rountree, he talked a lot about building online communities, and promoting the company via social media. The company seemed well aware of the potential there. The company increased its operating margins from under 10% in the six months to May 2014 to close to 20% in half year up to May 2016, so the cost cutting was working before Stranger Things hit the small screen. And looking back at the half yearly numbers licensing and royalty revenues had started to creep up before the show released.

I would prefer to say that this company’s management team, who I think are excellent, had been pursuing a sound, sensible strategy, that meant that if there was some catalyst, like a landmark TV show, it could take advantage. They seem to acknowledge the surge in popularity for all things fantasy mixture, particularly in the US as in May 2017, the company announced that US based third party retailers would be able to sell products online, which was a major policy shift.

Whatever lit the fire under sales growth, the company’s increasing efficiency—evidenced by the operating margin continuing to expand to a near 50% record high based on half year numbers—and shrewd use of cash equally impressive growth in earnings per share. The mantra had always been that the company was not seeking to pay dividends. But, it would if it had true surplus amounts of cash left after investing back into current operations to keep them tip-top and investing for growth without taking on debt or asking shareholders to cough up funds. Shareholders have gotten a regular dividend since Mr Rountree took over, even during the pandemic, and its been increasing too.

Again, I do think this company has an excellent management team. The strategy has always been clear, and I think it’s safe to say effective, and they are nimble enough to respond to opportunities. Plus, I once read that a worsening of margins was due to…poor planing and overstocking decisions by the CEO and admitted by them, with an exposition of what they learned and how they would not make the same mistake again. Candour and acceptance of responsibility like that is a very rare thing indeed. Usually, it’s some external factor at fault when mistakes are made, and everything to do with the decision maker when things go right. In fact that reminds me of a CEO of a private sports business that did admit that a lot of bad decisions had been made, people had underperformed, investments and recruitments had not worked as planned, and that ultimately the responsibility was theirs…so they were going to fire someone else.

DISCLAIMER: James J. McCombie owns shares in Games Workshop. The Storied Investor has no beneficial ownership position in any of the stocks or securities mentioned. No comment in this article should be construed as a recommendation of, or opinion regarding the future performance of, any stock or security or collection of them mentioned herein. Opinions expressed are the author’s and do not represent the views of The Storied Investor.