The Plus 500 (LSE: PLUS) share price is up 7.55% today so far. That is significant. Assuming it hold it will be the largest daily price move in the last year either to the upside or the downside.

The cause was not immediately apparent when looking at the RNS feed. There were a couple of transaction in own shares reports. But last week the company was active in buying back its own shares, and the share price was not surging.

But, on opening one, and reading the counterpart name as Odey Asset Management, I already had an idea of what happened.

Firesale

It’s been all over the news. Serious allegations have been made against Crispin Odey, founder and former key man at Odey Asset Management (OAM). He has now been ousted from the firm, but not before a slew of other financial organisations had declared they were suspending their relationship with the hedge fund which had some $4.8bn of assets under management.

OAM is stuck for cash. Plus 500 seems to have taken advantage of the situation and bought back some 8.2% of its issued share capital from OAM. It got those 7,327,605 ordinary shares at a price of 1,383p per share. That’s below yesterdays close, and far cheaper than the volume weighted average price of 1,422p it paid Liberium capital for 52,731 shares today.

The Liberium deal was part of the company’s ongoing share buyback plans. The OAM deal was opportunistic, and the company felt to was a good way to put some of the $950m in cash it had on the balance sheet at the end of March this year. And, it was not just Plus 500 that took advantage. Last Friday Frasers Group was bought up OAM’s stake in AO Group.

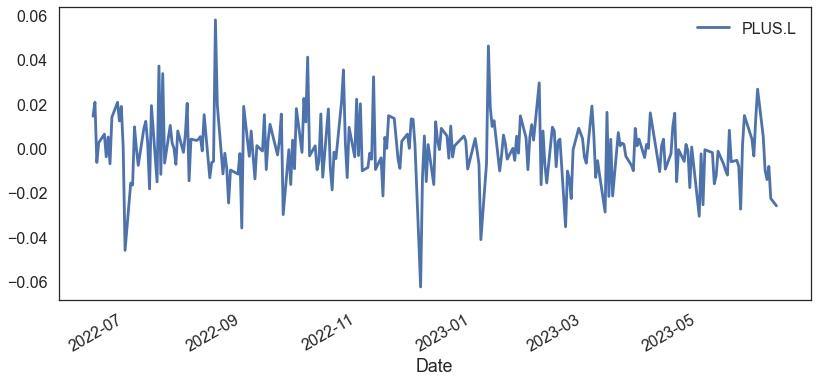

Plus 500 share price move

Say a company is forecasted to earn £10m next year and 10m shares in issue. Its has a forecasted earnings per share of 100p. Now, if the share count drops by 8.2% to 9,180,000 but the earnings forecasts stays the same, earnings-per-share jumps 9% to 109p. Investors should be willing to pay a little more for the shares now, hence their price increases.

So that’s what’s happened to the Plus 500 share price today, its future earnings per share and dividends per share have all increased for the remaining shareholders, and their shares got more valuable, hence their market price increased.

But investors have been ignoring the buybacks that happened all year, and not adjusted the share price up. In fact it has been declining. Perhaps, it was the size and the relative cheapness of the deal announced today that got their attention. Perhaps it made them sit up and notice that the company’s share count has declined from 114m in 2017 to 98m in 2022, and now it’s down to 83m. This is an outfit that does fairly well in terms of returning capital to shareholders.

Trading ideas

Generating stock ideas can be difficult. But two potential avenues to coming up with suggestions are relevant here. I am going to drop the specifics, because, well, it’s not palatable to discuss ways of making money from horrible scenarios.

So, let’s just say there is organisation that has lost goodwill, to put it kindly, due to something a key person has done. Its bankers have said they are stepping back. That’s going to put strain on its finances. If this were a publicly traded company then selling or shorting its stock would be an idea. But what if it’s not. Well it makes sense then that it would need to sell some of its assets. And, its assets are securities, like stocks, so finding out which companies shares it held big positions in is a worthwhile task.

But even if that logical leap was missed initially, then other outfits might start buying assets themselves. That’s another prompt to generate ideas of the basis of a firesale in stocks being on the horizon.

Logical, perhaps lateral thinking though the implications of a lot of events that are reported in the news, can generate stock ideas. Of course once the idea is developed, then it needs to be fleshed out and thoroughly considered before action.

DISCLAIMER: James J. McCombie owns shares in Plus 500. The Storied Investor has no beneficial ownership position in any of the stocks or securities mentioned. No comment in this article should be construed as a recommendation of, or opinion regarding the future performance of, any stock or security or collection of them mentioned herein. Opinions expressed are the author’s and do not represent the views of The Storied Investor.