The Ocado share price has more than halved over the last 12 months. It narrowly avoided being kicked out of the FTSE 100 and into the FTSE 250 yesterday. But it was not always this way. For example, shares in Ocado were changing hands for around 85p at the start of 2013. By the end of the 2013 the Ocado share price hit 447p. That was a gain of something like 425% which made Ocado the best performing UK stock in 2013.

And that performance in 2013 is what we are interested in here. Can we discover what was happening with Ocado around that time to make investors propel its share price from 85p to 447p, and make it the best performer of that year. Are there identifiable reasons that we can use to identify stocks that might be top performers in the future?

Ocado share price from IPO to 2012

Ocado stock hit the London Stock Exchange at a price of 180p in July 2010. Investors were buying shares in the largest dedicated online supermarket in the world by turnover. The vast majority of the products customers ordered were sourced though Waitrose, a U.K based supermarket, along with some from small range of Ocado own label products. A single highly automated, customer fulfilment centre (CFC), located in Hatfield, Hertfordshire, handled orders, with distribution going first to spokes, and then finally by van to customers homes.

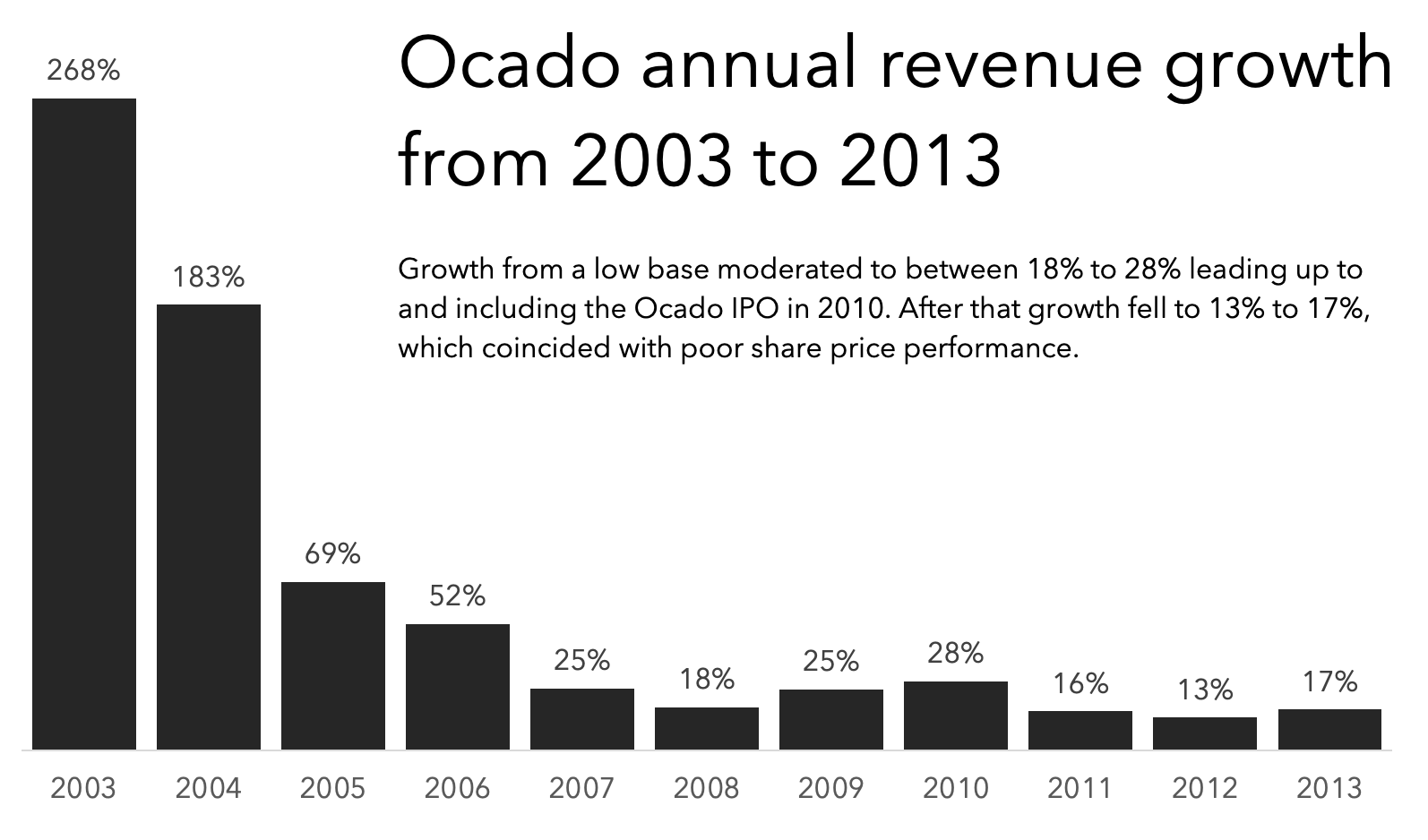

Investors were also buying into a growth story. Annual revenue growth in 2003 and 2004 was 268% and 183% respectively. Those growth rates were off a low base. Growth did fall to 69% in 2005 and 52% in 2006 and then to 25% in 2007. In the years prior to the IPO revenue growth came in at 18% in 2008, and 25% in 2009. That is still impressive. It is well above normal levels of GDP growth in the UK.

The Ocado share price hit 290p in Feb 2011, possibly buoyed by the 28% revenue growth in 2010. However, in December 2011 it fell to 52p, rallied to 134p in March 2012, but fell back to 56p in November 2012. That period of lacklustre performance coincides with annual revenue growth falling to 165 in 2011, and half year numbers hinting that 2012 annual revenue growth would be lower still.

Investors who were buying for growth would not be satisfied with arguments about profitability improvements. Pointing to Ocado being profitable at the gross level since 2007, and making an operating profit in 2011, would, and probably should not satisfy someone buying into a growth story.

So, to take Ocado from laggard to top performer, growth had to be back on the menu.

Filling more baskets

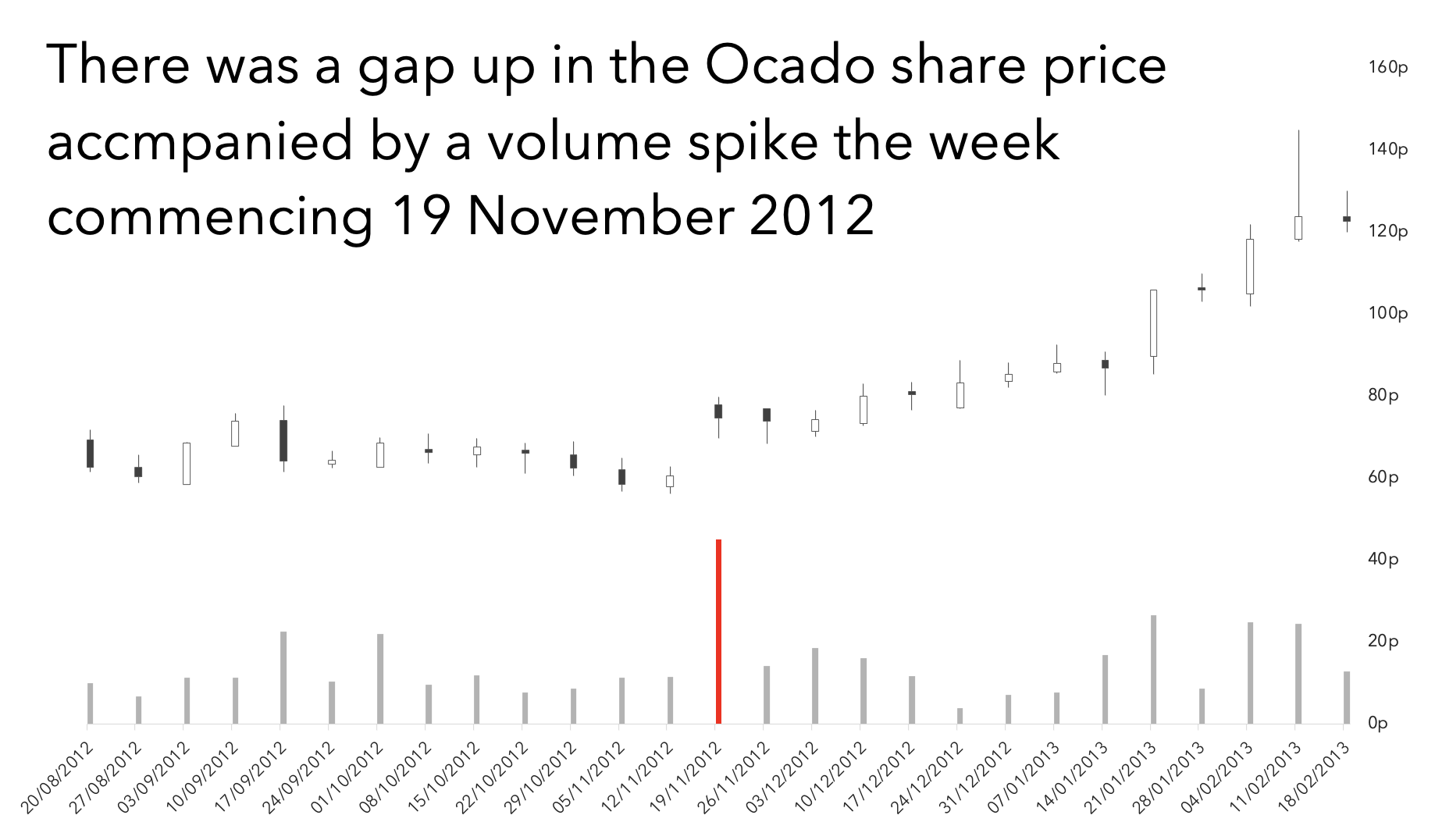

Something happened to the Ocado share price on 19 November, 2012. The price gapped up on high volume. From that point on the direction was up. This looks like the start of the run that made Ocado the top performing stock of 2013.

This price and volume event, which is evident on scanning a weekly price chart, is meaningful because something of fundamental importance happened on the 19 November 2012. Ocado told the markets that it had:

- Extended the term of a Capex facility by 18 months to July 2015

- Raised £35.8m through a share placing

- Also, current trading, improved sales growth of 13.7% in 6 weeks to 11 November

The third point was probably not what got investors excited. But the first two points did. See, Ocado was in the process of building a second CFC. This would increase its capacity and allow it to expand: more growth.

The second CFC was almost finished in November 2012. Land had been purchased for this back in March 2011. By October 2011 groundworks and the external building were complete and the mezzanine was being installed. Material handling equipment (MHE) was installed and system testing was underway in mid-2012. The project was forecasted to cost £210m which included £90m for the land, buildings and fit out and £120m (converted from Euro’s ) for the MHE. Remarkably for a large capital project, the second CFC was estimate to come in on budget and on time, with it due to start filling customers orders in February 2013.

Doubling capacity

There was a snag though. The project was once claimed to be fully budgeted for. Yet in the run up to November 2012, this claim was in doubt. At the end of October 2012 Ocado had net debt of £93.4m, cash of £56m and drawings on its existing Capex facility of £85.3m. It still needed to spend a final £46m to complete the second CFC.

There was a little under £5m left on the Capex facility to draw on. It would have had to exhaust all its cash to complete the CFC on time. Then it would have to repay its Capex facility by the end of 2013, which did not give it a lot of time to spin the new CFC to capacity and max cash generation. Then it would likely be in breech of the various debt covenants that it had with its creditors. This made the completion of the CFC, ready to start serving customers in February of 2013 seem like a but of a stretch.

So, a successful placing of £35.8m which in turn allowed those creditors to extend the term of the Capex facility and adjust the covenants was huge news. It made the completion of the CFC on time and on budget achievable. And it was achieved. Further wins occurred during 2013. There was a partnership with Morrisons. A former M&S chairman joined. Ocado started to expand into non-food areas, with the launch of specialist pet website Fetch (later bought by PAWS) for example.

Ocado’s story after that November 2012 event was one of doubling capacity and expanding its range. It was changing from an online supermarket to a hypermarket. And investors were satisfied. At least though 2013. After that things turned sour and a new story, new focus was needed. That came from promoting the value of the proprietary technology and software that powered the CFC’s and distribution network. But that is a tale for another time.

DISCLAIMER: James J. McCombie owns shares in London Stock Exchange. The Storied Investor has no beneficial ownership position in any of the stocks or securities mentioned. No comment in this article should be construed as a recommendation of, or opinion regarding the future performance of, any stock or security or collection of them mentioned herein. Opinions expressed are the author’s and do not represent the views of The Storied Investor.

1 Comment