Volatility. Some love it. Most hate it, unless it’s in the right direction. The most volatile UK stocks in 2022 have been covered in a previous article. But, things have changed, time has moved on. How about a look at the most volatile FTSE All-Share stocks over the last six months? Sounds like fun? Let’s dive in.

The most volatile UK stock

Amigo Holdings was the most volatile. Its six month volatility was 148%. It currently has a market cap of . I am sure I looked at this stock once, and it made me wince, but it was definitely worth more than the current market cap of $713k. A look at the price chart confirms the fall in Amigo’s share price has been dramatic.

Aston Martin, a FTSE 250 stock, makes the top ten with a six month volatility of 68%. I looked at this stock back in 2021. I was not tempted then. I am glad I felt that way. Actually, I might as well just list the top ten most volatile UK stocks over the last six months, and their industry groups and current market capitalisation.

The top ten most volatile FTSE All-Share stocks over the last six months

- Amigo holdings, banking services, market cap £0.7m six month volatility 148%

- De La Rue, professional & commercial services, market cap £79m, six month volatility 105%

- Ross, freight & logistic services, market cap £2m, six month volatility 91%

- Vanquis Banking, banking services, market cap £580m, six month volatility 85%

- Shaftesbury Capital, residential & commercial REITs, market cap £2,124m, six month volatility 82%

- Gulf Marine Services, oil & gas related equipment and services, market cap £47m, six month volatility 72%

- Triad, software & IT services, market cap £24m, six month volatility 69.6%

- Carlco, chemicals, market cap £10m, six month volatility 69.5%

- Aston Martin, automobiles & auto parts, market cap £1,621m, six month volatility 68%

- Marston’s, hotels & entertainment services, market cap £215m, six month volatility 66%

There a few noteworthy mentions outside the top ten. Rolls-Royce is the 26th most volatile stock on 57%, and Darktrace is 13th place on 63%.

Stock sector volatility

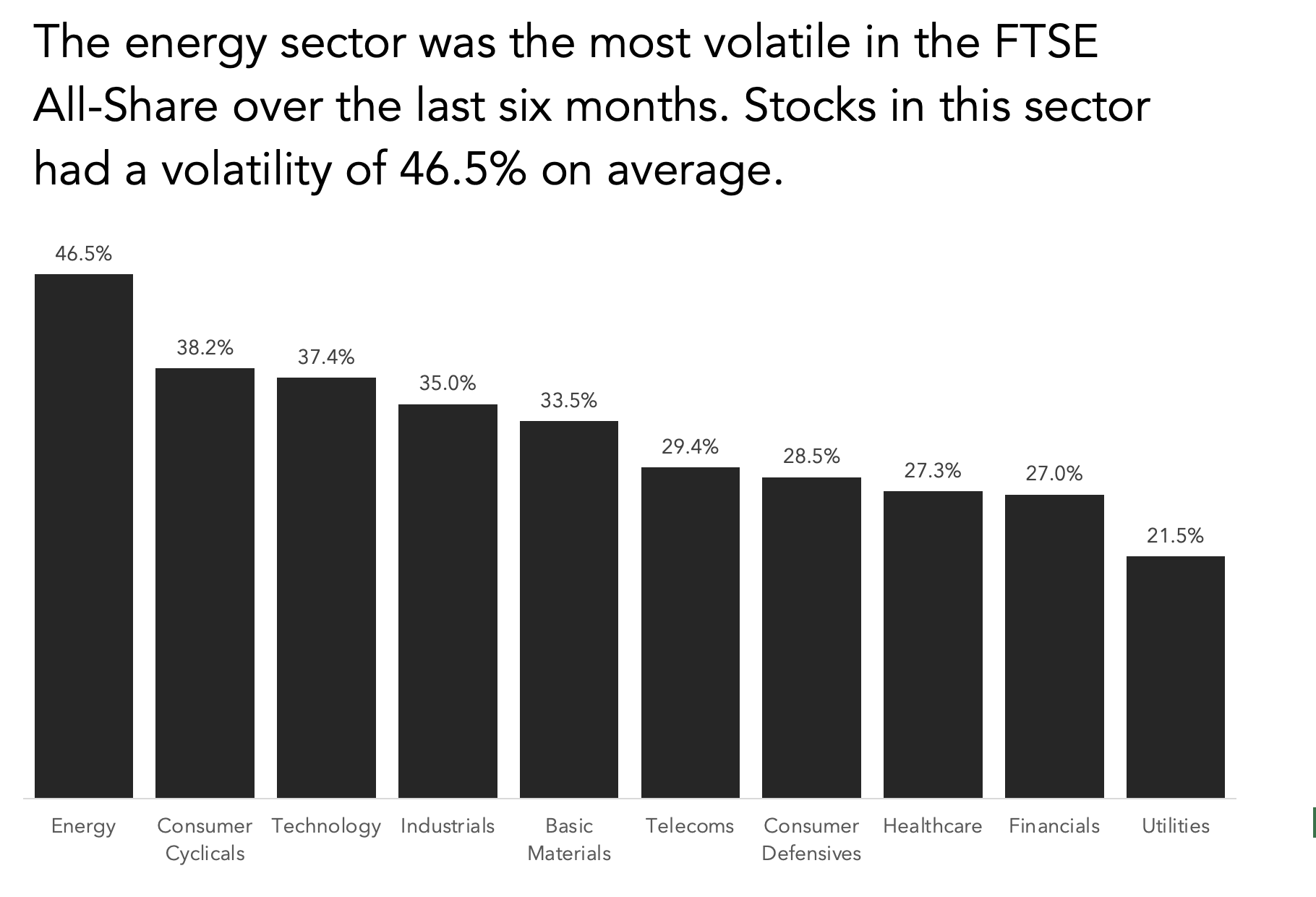

Just like over 2022, over the last 6 months energy is unsurprisingly the most volatile sector. Stocks in this sector average 47% in six month volatility. The least volatile was Utilities on 21%.

I think utilities being the least and energy being the most volatile is interesting. After all, you would expect the volatility affecting those that sell oil and gas, to be felt by those using it to generate and sell electricity. Now of course, the utility companies are not just electricity generators. There are water company pure plays and multi-utility ones in there. But, I still think this lends credence to the view that utilities are defensive plays. They are heavily regulated and whilst they might not get to raise prices indefinitely, like the oil and gas companies benefit from rising il and gas prices, they don’t tend to lower them much, if at all.

DISCLAIMER; James J. McCombie does not own any of the stocks mentioned. The Storied Investor has no beneficial position in any of the companies mentioned.