I don’t have any stocks from the containers and packaging sector (that’s properly a sub-sector). That might be a mistake. A trend towards online shopping is increasing the demand for packaging solutions, particularly paper based ones, which is preferred now as a sustainable solution. Population growth should also help, more people, more orders shipped, more packaging needed. However, there is also a trend towards less packaging, but I doubt manufacturers will reduce prices per unit just because it has less material. But then again engineering lower material solutions might add additional costs.

Is the containers and packaging business worth investing in?

I could go on listing pros and cons. Perhaps it’s better to turn to the numbers. Global production of packaging paper and board increased from 203,449 thousand metric tons in 2010 to 264,058 in 2021. The compound annual growth rate in volume is 2.4%, not earth shattering. Add in price inflation—which has been persistently above 2.7% per annum over those years—on top of volume growth and the revenues growth rate for the industry will be higher. Global GDP growth averaged around 3% in the decade before the pandemic, so the paper packaging business looks like it has outperformed. So it’s looking like an attractive investment opportunity. Now to look at the options to invest in the UK markets.

There are six UK listed containers and packaging companies. Three of them are relative minnows. Three have market caps in the billions. These are so big that they are amongst the largest paper packaging producers in the world. Using 2021 revenue numbers Smurfit Kappa (LSE: SKG) is number five, Mondi (LSE: MNDI) is number seven and DS Smith (LSE: SMDS) is number eight.

It is from amongst the big fish that I am going to look for a winner.

Mondi seems to be the top UK container and packaging stock

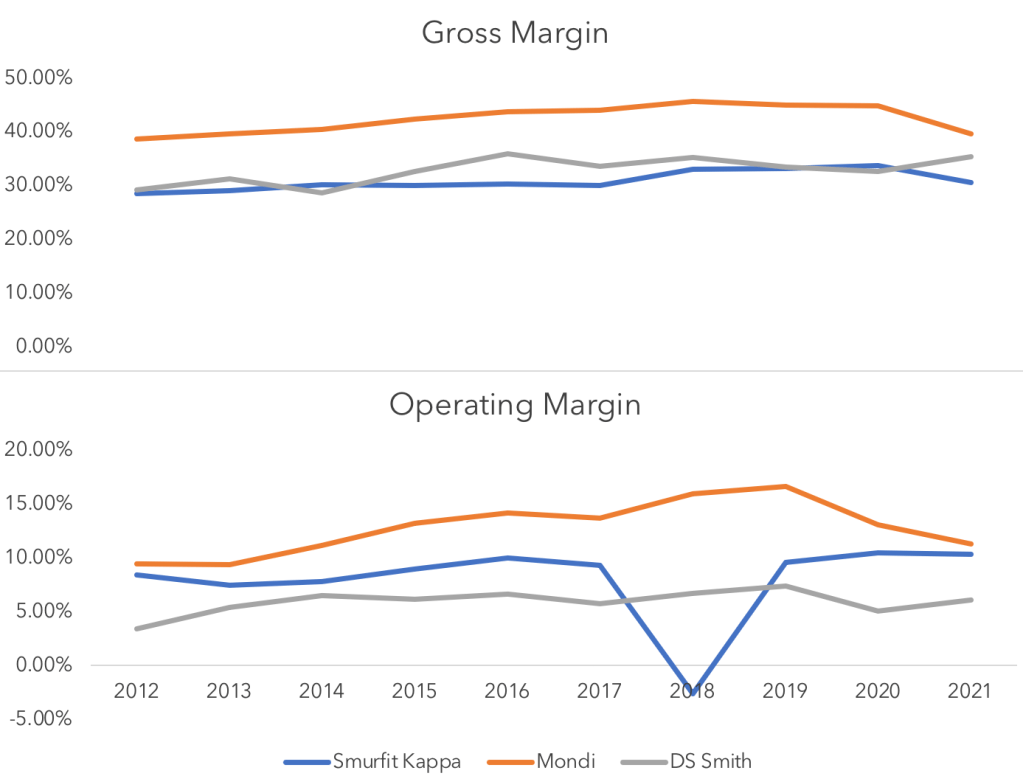

Mondi, with a market cap of £7.4bn, is not the biggest company. Smurfit Kappa with its £8.9bn market cap takes first place and DS Smith is third on £4.9bn. Yet Mondi looks like the clear winner in terms of profitability. It has significantly higher five year average gross and operating margins (43.8% and 14.1%) than Smurfit (32.1% and 7.4%) and DS Smith (31.4% and 6.2%).

I might be tempted to have written off Mondi given its 4.79% average annual revenue growth which is lower than Smurfit’s 7.3% and DS Smith’s 5.6% had I started with the top line. Perhaps it’s lucky I did not or perhaps I wanted to frame Mondi in a more favourably way. Or then again it might be because I wanted to make the point that I would rather take a slower growing company over a higher growth one if it is significantly more profitable.

If now jump to the bottom line then Mondi takes too spot again. it’s five year average return on equity is 17.9% which has Smurfit and DS Smith—with their returns of 8.5% and 9.0% respectively—beaten comfortably.

Does buying Mondi stock buy competitive advantages or operational efficiency?

It is difficult to imagine where Mondi would get sustained competitive advantages from that would explain its profitability outperformance. The technology of turning paper to cardboard, which is the main business line, is widely known. Perhaps some customers might be locked in to using its solutions, but would a competitor not be able to replicate the packaging fairly easily if asked? And if they can replicate in terms of function and form then presumably it would not cost a manufacturer much to switch. And competitors are easy to find and the alternatives are not hard to asses in terms of quality or reliability and the costs of changing.

All three have global operations and given the relative stability in terms of revenue shares of the top ten firm in paper packaging, perhaps there are advantages that accrue to incumbents, perhaps scale, but that still does not explain Mondi’s profitability. It completes with Smurfit and DS Smith in some geographic markets, but not others. Where they do compete sometimes Smurfit or DS Smith has the higher market share other times its Mondi. It’s not the case that Mondi has cornered the market in one territory or region.

It does appear that Mondi is simply more operationally efficient than its rivals. It does have a large share of its operations in Eastern Europe compared to other two. That might be the explanation. Now, being operationally efficient is not a bad thing. It’s the way to go in a sector when you have no real edge on other incumbents but the incumbents themselves are protected from new entrants to a degree.

But, other firms can learn to be more operationally efficient, perhaps by mimicking Mondi’s practices. It’s not as defensible a position as a genuine competitive advantage. However, the fact remains that containers and packaging looks like a sector that appears attractive for me to invest in. And of the UK stocks in that sector, Mondi is right now the one I would go for.

DISCLAIMER: James J. McCombie does not own any of the shares mentioned. The Storied Investor does not have any beneficial position in any of the shares mentioned.