The Games Workshop (LSE: GAW) share price went up over 15% after it told investors that it had reached an agreement with Amazon for the rights of its Warhammer 40,000 intellectual property. There are still details that need to be ironed out, but as it stands, Amazon should be developing Warhammer 40,000 into a TV show or a Movie, and get the merchandising rights for associated products. Superman and The Witcher star Henry Cavill has already announce that he will star and be an executive producer in a TV adaptation, fulfilling what he called a ‘lifelong dream’.

Games Workshop’s management has always stated that triple-A games and movies and TV shows were where it wanted to showcase its Warhammer property. Today, it has delivered. But that’s not to say they have been sitting on their hands. The company generated licensing revenue of £16.3m and £28m for 2021 and 2022 respectively, and Warhammer has made its way from the table top to video games. But, given the share price reaction, I would wager that investors believe the Amazon deal will be a lot larger.

How much will Amazon pay for Warhammer 40,000?

Amazon paid $250m for the rights to the develop its Rings of Power TV series. Of course, the Lord of the Rings is a juggernaut compared to Warhammer. But consider what Amazon actually got for their money. Yes the three volumes in the Lord of the Rings story are included, as is the Hobbit. But, there have been wildly successful, and beloved film adaptations made of the these. The appendices for these books are the only fresh material to draw from that was included in quarter of a billion price tag.

“We have the rights solely to The Fellowship of the Ring, The Two Towers, The Return of the King, the appendices, and The Hobbit. And that is it. We do not have the rights to The Silmarillion, Unfinished Tales, The History of Middle-Earth, or any of those other books…We worked in conjunction with world-renowned Tolkien scholars and the Tolkien estate to make sure that the ways we connected the dots were Tolkien-ian and gelled with the experts’ and the estate’s understanding of the material.”

Patrick McKay, The Rings of Power showrunner speaking in Vanity Fair February 2022

A fresh world, characters and stories to exploit could be worth a lot to Amazon. Perhaps not $250m, but could it come close? Even a quarter of that amount—and there should be additional merchandising royalties—would be enough to significantly boost Games Workshops licensing revenue. But for know it’s just speculation. Games Workshop has said that this deal will not affect its estimates for its 2023 revenues and profits. That means two things. One, investors should not expect any material revenue from this tie-up until the 2024 financial year at least. Two, investors are getting no hints as yet as to what this deal might be worth.

Games Workshop share price

Amazon deal or not, Games Workshop has been a stock market darling for at least half a decade. Revenues have grown at 17% per year on average for each of the last five years. Operating profit has grown at 21% each year and so has net income. The Games Workshop share price has gone from 2,516p to 8,480p in half a decade. It has been higher. It hit an all time high of 12,043p in September 2021, but has falling since.

Investors do seem to have cooled on the stock over the last 12-months or so. Maybe they are concerned about the 12% year on year revenue growth from 2021 to 2022. That’s lower than the 37% the year before, in 2021. They might be worried that Games Workshop’s revenue growth is stalling. That is running out of growth opportunities. Well, the bump from the Amazon deal announcement might be what this stock needs to start heading higher again, if investors start to believe that impressive top line growth is coming back.

Where did the growth come from?

From 2002 until 2016, the Games Workshop story was not an enticing one. Revenues rose a little, fell back, stayed flat, moved a little higher, then dipped again. But, looking at a chart of the company’s revenue from 2002 to 2022, it’s clear that something happened around 2017. Annual revenues leaped from £118m to £158m in 2017, and then went up every year until the most recent one.

What could have happened around 2016 and 2017 to cause the change? I could read through the company’s annual reports and see what the strategy was. But, I don’t what my thinking to be coloured by what I might read. So, I will turn to numbers first.

Trading up

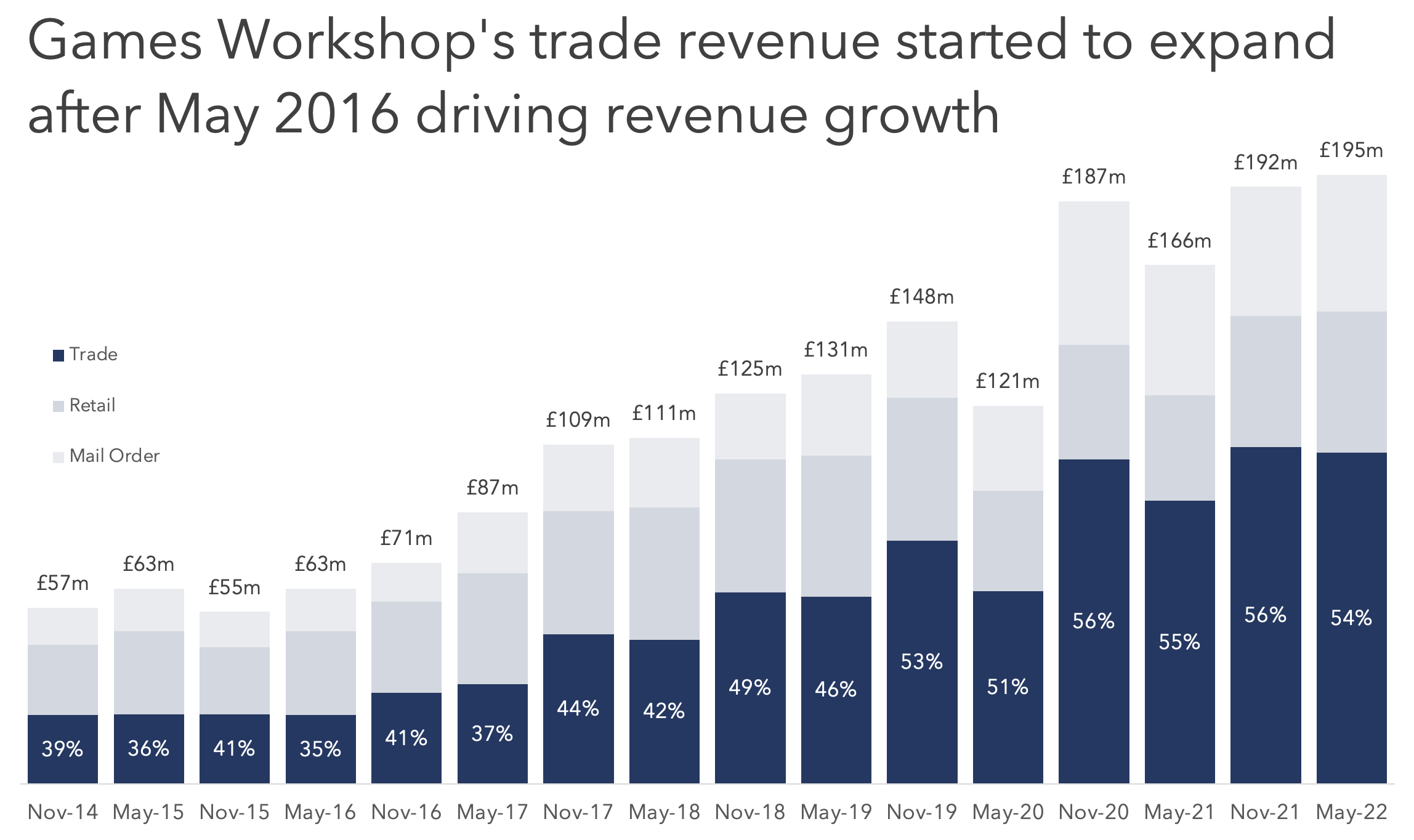

A look at interim results might help pinpoint when the change occurred. Games Workshop provides a breakdown of its revenue into three streams: Trade, Retail and Mail Order (later renamed to online), so looking at half-yearly numbers for these three streams might be revealing.

What I find is that the results for the six months up untill November 2016 seem to be where things started to change. I see a jump in revenue from £63m to £71m. That’s a recent high point. Furthermore, the trade revenues as a percentage of total revenue jumps from 35% to 41% in that half-year. After this point the trend for this percentage is higher. By May 2022, it’s up to 54%.

Trade revenues are from products sold by third parties, and not from Games Workshops own stores. So, they are denominated in foreign currencies. Now, in 2016 the UK voted to leave the EU. The pound had already been weakening before the vote, but it moved sharply lower after the vote and continued to trend lower. Since Games Workshop reports in sterling, if it is weakening, that would inflate revenues earned in a foreign currency. So that could be a reason.

Stranger things have happened

July 15, 2016 was the day that Stranger Things dropped on Netflix. The show featured tabletop role playing games front and centre, and it is wildly popular. Is this too soon to have made a meaningful contribution to Games Workshops revenues? Perhaps, but I do think that the growth in the show’s popularity helped over the years. Then there is social media, in particular video sharing sites. These have given an audience to niche hobbies like miniature model painting, and that’s certainly good for Games Workshop. In addition they can help find a global audience for a product manufactured and developed in the UK. YouTube has been around long before 2016, but perhaps this year was a turning point for engagement and community building. Further investigation might help answer this question.

In a trading statement from October 2016, the company does state that the weaker pound has helped. Looking back to June 2016—before Stranger Things released—and licensing revenue being higher than expected was expected to contribute to better than expected results. In December 2016 both factors are quoted as helping lift results.

Now turning to the annual reports, which give a fuller picture of the strategy employed. Over the 18 months before May 2017, model quality was improved. Some 400 new models were released across the various intellectual properties and 17 new colours of paint. New magazines were released from the groups publishing business. A website warhammer-community.com was launched in November 2016, serving as a gateway for the companies wares. There were other changes, but it seems clear that explaining the turn around in revenues by factors external to the company would be unfair.

I would suggest that a sound strategy was elevated, perhaps serendipitously, a weakening currency and the launch of a TV juggernaut that shone a favourable light on tabletop games and all that entails. Imagine what a TV show centred around Warhammer itself could do.

DISCLAIMER: James J. McCombie owns shares in Games Workshop. The Storied Investor has no position in Games Workshop.

3 Comments